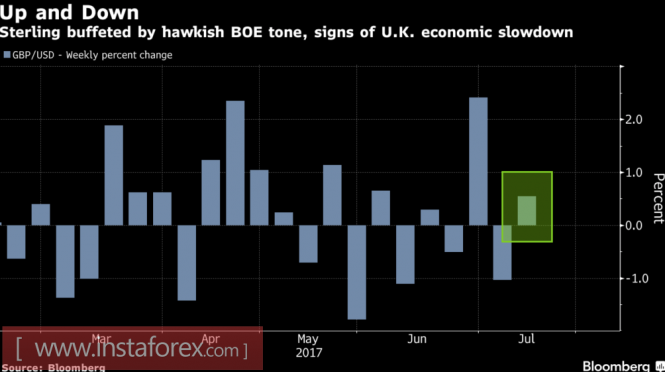

Taking advantage of the strong labor market data of the UK, rumors about tightening monetary policy by the BoE, the moderately "dovish" rhetoric of Janet Yellen and weak data on US inflation, retail sales and consumer confidence, the GBP/USD jumped to its highest level since September. The trade-weighted sterling's exchange rate is currently 5% higher than the seven-year lows that took place in October, which reduces the risks of acceleration in the CPI. Is this what the Bank of England sought?

Weekly dynamics of the GBP/USD pair

Source: Bloomberg.

The hawkish speeches made by the representatives of the Monetary Policy Committee, not only hinted at raising rates, but also dealing with the British QE, appears to have done their job: investors believe that the BoE will tighten monetary policy even amid the slowdown of the UK economy. The likelihood of raising the interest rate before the end of this year are estimated by the market at 57%, so the Bank of England is among the top three candidates for monetary tightening among the G10 currency issuers. This circumstance, along with a reduction in political risks, most of which are already included in the GBP/USD prices, allows BTMU to forecast that the pair will strengthen to 1.25 by the end of the year. The bank believes that amid a drop in the unemployment rate of the US to a new cyclical low of 4.5% and growth in employment of 175,000 this spring, the anti-crisis scenario of the BoE is no longer relevant.

Nomura stands by with a "bullish" view on the pound, however, Credit Agricole and Citigroup are not going to leave the ranks of the "bears". According to them, the growing risks of a slowdown in Britain's GDP will keep the BoE from raising interest rates. Most of it will depend on the data on inflation and retail sales, the release of which allows the sterling to claim the role of the most interesting currency of the week by July 21.

If retail trade is in fact better than expected, investors will start to think that even in the condition of falling real incomes, the population pushes up domestic demand. The strength of the indicator will raise the chances of a tightening of monetary policy by the BoE and will allow the GBP/USD to continue the rally.

Dynamics of average wages and inflation in Britain

Source: Trading Economics.

Traders should not forget about the next round of negotiations between Brussels and London regarding Brexit. In the first series, Britain proposed requirements for EU nationals that reside in the UK, which signaled a soft divorce scenario and supported the bulls on GBP/USD. Nevertheless, Brexit secretary David Davis said that it's time for the parties to dismiss differences and begin working on finding a compromise, which could have a negative impact on the pound.

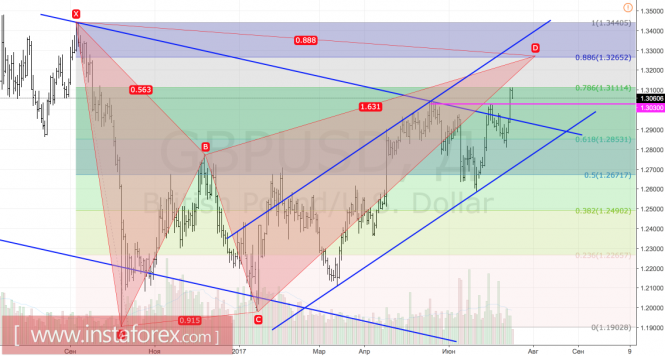

Technically, the bulls for GBP/USD managed to get prices from the rising long-term trading channel, which increases the risks of continuing the upward movement. While on the way buyers become resistive at 1,311. If the retest is completed successfully, the road towards the 88.6% target will be opened for an inverted "Bat" pattern.

GBP/USD, daily chart