Trading plan for 03/07/2017:

The US Dollar is gaining slightly to the other currency pairs. It has risen the most GBP (0.24% and CAD (0.22%). EUR/USD is slightly above 1.1400, GBP/USD has slipped below 1.3000, USD/JPY is approaching resistance at 112.50. WTI oil is up 0.35% and is trading at $46.20, an ounce of gold costs $ 1,237. On the Asian stock market was a very quiet session, the index fluctuations barely exceeded 0.1%. The Nikkei 225 is up 0.12%, Hang Seng 0.09% and Shanghai Composite is 0.03% under the line.

On Monday 3rd of June, the event calendar will be dominated by PMI Manufacturing data releases from across the Eurozone, Great Britain and the US. Moreover, Unemployment Rate data from the Eurozone will be released as well.

EUR/USD analysis for 03/07/2017:

The PMI Manufacturing data from Spain, France, Germany, and Italy are scheduled for release in the early hours of European trading session. Global investors are expecting data to be at least in line with the last month's figures. However, better than last month's data are welcome as well. All of the current PMI's across the Eurozone are above the fifty level, which separates the contraction from the expansion. Because the manufacturing sector represents nearly a quarter of total Eurozone's GDP, the Eurozone Manufacturing PMI is a significant and timely indicator of both business conditions and the general health of the economy.

The other good data to be released today is the Unemployment Rate from the Eurozone (released at 09:00 am GMT), which is expected at the level of 9.3%. The rate is still relatively higher than for example US rate (4.3%), but it is close to the lowest level in 8 years anyway. The downward trend is an important sign and today's update is on track to reaffirm that the economic recovery is poised to continue.

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The market is trading in a narrow range between the levels of 1.1444 - 1.1386 in overbought market conditions. Moreover, there is a visible bearish divergence between the price and the momentum indicator, which might result in a down move towards the support at the level fo 1.1386 to test it. Worse than expected data from the Eurozone might accelerate the downside.

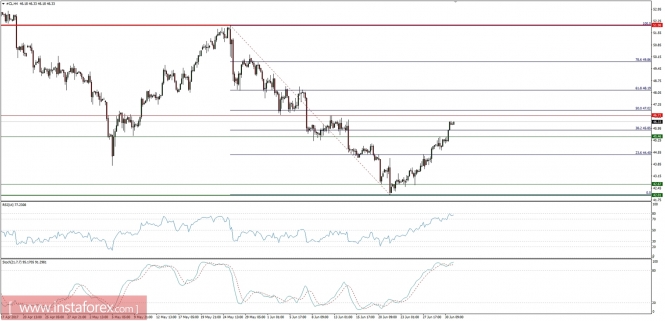

Market Snapshot: Crude Oil price under important resistnace

The WTI oil prices have been recovering for the recent six days. At present, the bulls have managed to push the prices towards the important technical resistance at the level of $46.71. This level is just below the 50% Fibo retracement at the level of $47.02, so a corrective pullback might be expected around this level, especially if we take into consideration overbought market conditions. The next technical support is seen at the level of $45.46.

Market Snapshot: Gold is close to the trend line support

The mid-term trend line support around the level of $1,238 is being tested again by the bears. This support is very important as the 200 DMA is lying just around this level, so any breakout below would have long-lasting consequences for the bulls. The next important technical support is seen at the level of $1,213.