Trading plan for 20/07/2017:

The volatility during the Asian session is still very limited, with no major movements across the board. EUR/USD is at 1.1510 level, USD/JPY 112.10 level, AUD/USD is at 0.7940 level. WTI oil is higher after yesterday's inventories data, currently, the price of the barrel of oil is $47.10. No market reaction after Bank of Japan interest rate decision.

On Thursday 20th of July, the event calendar is busy with important economic releases. In the morning, the UK will present Retail Sales with Auto Fuel data, the European Central Bank will decide about the Interest Rate, Deposit Facility Rate, and Marginal Lending Facility and 45 minutes later Mario Draghi will participate in the ECB Press Conference. During the US session, Unemployment and Continuing Claims will be released, together with Philly Fed Manufacturing Index data.

EUR/USD analysis for 20/07/2017:

The most important event of the week, ECB Interest Rate Decision, and Press Conference is scheduled for release at 01:45 pm GMT and 02:30 pm GMT respectively. The market participants do not expect any change in the level of the interest rate, so it should stay at the level of 0.0%. The Deposit Facility Rate, Marginal Lending Facility, and Asset Purchase Target should all remain unchanged as well.

The ECB is slowly moving towards normalization of monetary policy and a lack of dovish attitude in relation to the QE program is possible even in July. The reduction of the buy-back program (currently 60billion Euro per month) is unavoidable in the next few months, otherwise, the bank will lead to possessing more than 33% bonds of a given country, thereby breaking the imposed restrictions. Nevertheless, among the members of the ECB Governing Council, the direction and pace of change have not been fully agreed on yet, although recent weeks indicate that it is increasingly closer to consensus. The increase in confidence in the economic recovery has already removed the openness to lowering interest rates from the earlier ECB statements. On the other hand, however, the uncertainty about the future path of long-term inflation restraint against a more aggressive reverse in monetary policy. At the same time, the Governing Council has no interest in fueling the appreciation of the Euro and rising yields on government bonds, so at the press conference, President Draghi can look for opportunities to balance the overall message, which would cause a Euro sell-off across the board.

Let's now take a look at the EUR/USD technical picture at the H4 timeframe. The market is currently in a corrective cycle after establishing a local high at the level of 1.1583. Currently, the price is trading just above the important technical support at the level of 1.1489. Any hawkish statements from the Draghi during the press conference will result in a spike up towards the 1.1583 high and a possible breakout higher. Any dovish statements will result in a sell-off towards the level of 1.1368. Anyway, the most important technical support is still at the level of 1.1310, so as long as this level is not clearly violated, the overall bias is bullish.

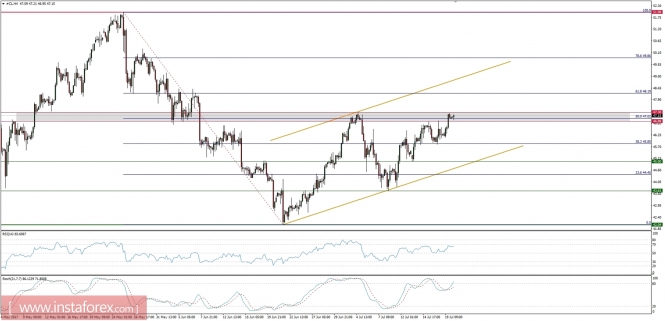

Market Snapshot: Crude Oil at the important resistance

After yesterday's stockpiles data, the price of Crude Oil has managed to get to the important technical resistance at the level of $47.30. This level is just above the 50%Fibo retracements of the last swing down which makes this zone even more interesting. The market conditions look overbought, but the momentum indicator points to the upside, so as long as the level of $46.88 holds, there is still a chance for a breakout towards the next Fibonacci level at $48.19.

Market Snapshot: USD/JPY bounced from the support

The price of USD/JPY had bounced from the important technical support at the level of 111.64 and now is trying to test the intraday resistance at the level of 112.32. The oversold market conditions and clear bullish divergence support the bullish case and if the resistance is violated, the next important technical resistance is seen at the level of 112.74.