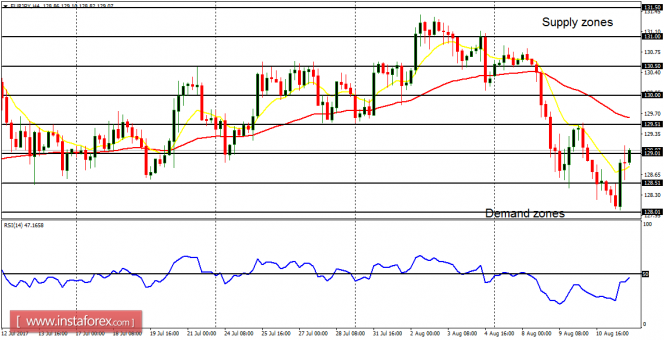

EUR/USD: This pair moved sideways last week. In case it moves sideways throughout this week, the bias would become neutral. However, a movement above the resistance line at 1.1850 and below the support line at 1.1700 would create a directional bias. EUR could be seen going upwards versus AUD and NZD this week.

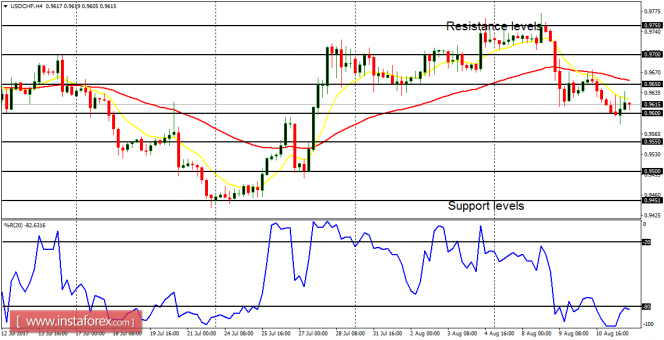

USD/CHF: A "sell" signal has already been generated on the USD/CHF pair, owing to the Bearish Confirmation Pattern in the market. Unless USD gains some stamina, further bearish movement would be witnessed this week. The targets are the support levels at 0.9600, 0.9550 and 0.9500. A movement above the resistance level at 0.9750 would help the pair to restore a bullish bias, and render the bearish expectation invalid.

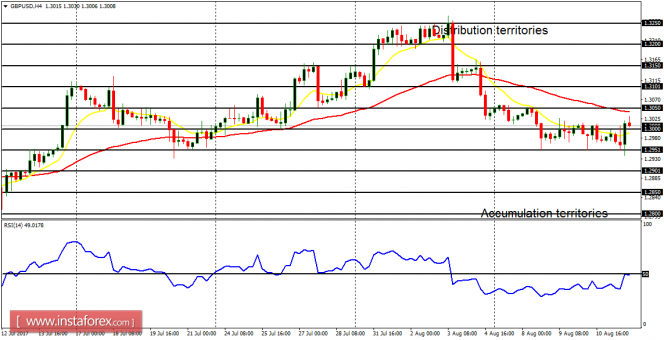

GBP/USD: In the context of a downtrend, GBP/USD went sideways. Further sideways movement would result in a short-term neutral bias on the market; while a movement to the downside would lay more emphasis on the recent bearishness in the market. There is also a possibility of a rally (though it could be short-term). GBP could go upwards versus AUD and NZD this week.

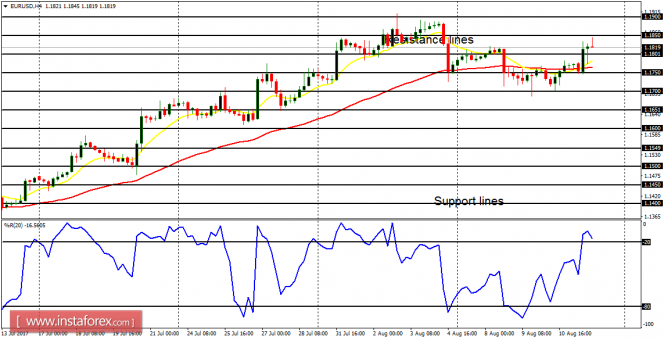

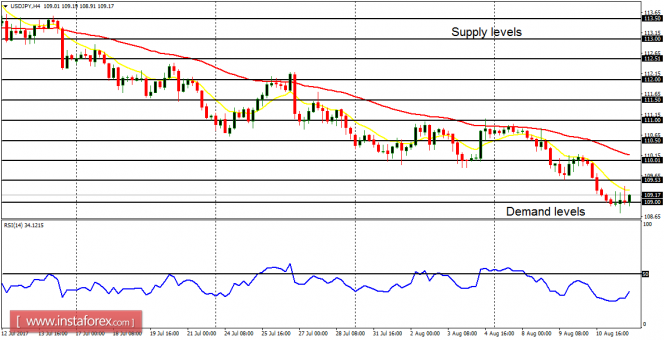

USD/JPY: From the July high of 114.49 USD/JPY dropped 550 pips, testing the demand level at 109.00 on Monday. The demand level would be tested again, and breached to the downside, as other demand levels at 108.50 and 108.00 are aimed. The outlook on JPY pairs remains bearish for this week.

EUR/JPY: This pair dropped 250 pips last week, almost reaching the demand zone at 128.00. The upwards bounce that happened at the end of the week has given another wonderful opportunity to sell at better prices in the context of a downtrend. The next targets for bears are the demand zones at 128.50, 128.00 and 127.50.