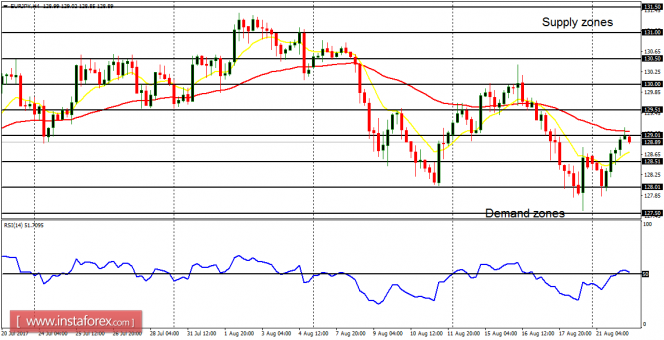

EUR/USD: This pair made some bullish effort on Monday – but that seemed not significant enough to affect the ongoing neutrality of the market. A breakout that can put an end to the current neutrality would happen before the end of this week, and that would make price go above the resistance line at 1.1900 or below the support line at 1.1650. A movement to the downside is more likely, but the support line at 1.1750 ought to be breached to the downside first (it has been tested many times without being broken).

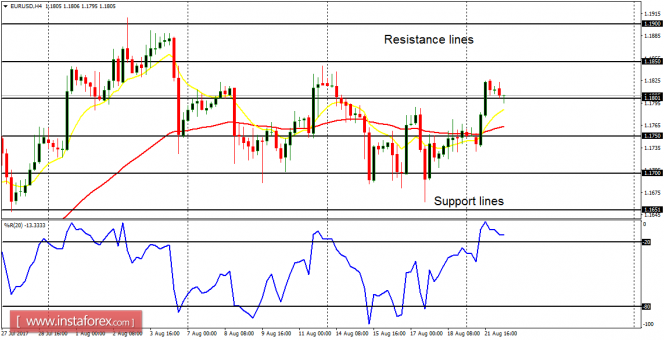

USD/CHF: There is a bearish signal on the USD/CHF pair. The bearish signal would become stronger once the support levels at 0.9600 and 0.9550 and breached to the downside. There could also be a bullish movement, which may render the short-term bearishness invalid, for USD is supposed to go upwards this week, while CHF becomes weak.

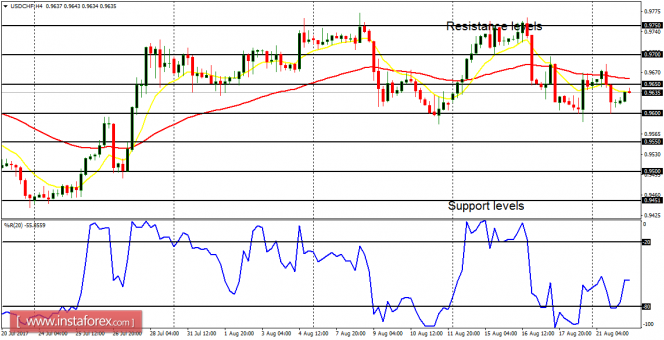

GBP/USD: This pair moved sideways yesterday in the context of a downtrend. There is the Bearish Confirmation Pattern in the chart, but further sideways movement could result in a short-term neutrality. There would be a movement above the distribution territory at 1.3000 or a movement below the accumulation territory at 1.2750, before there is a directional bias. The current impediment is the accumulation territory at 1.2850, which needs to be breached at first, after being tested many times.

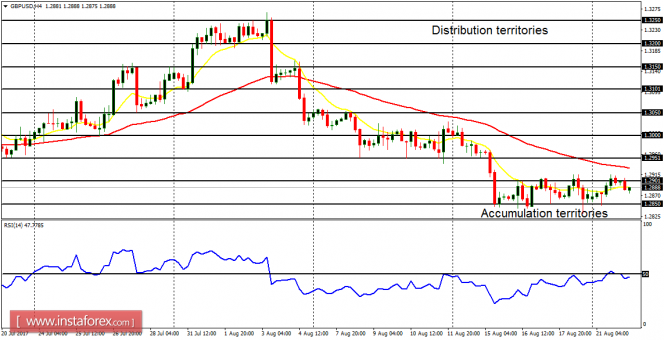

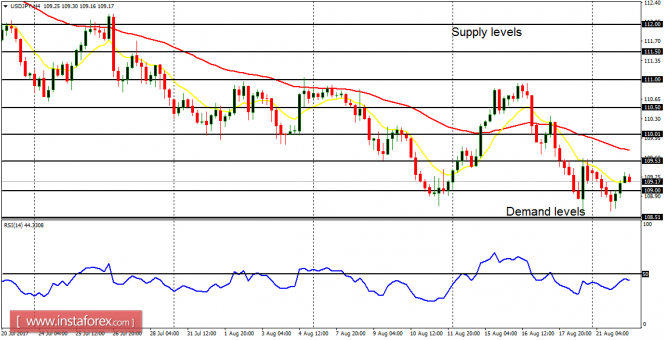

USD/JPY: This currency trading instrument reflects some power tussle between bulls and bears. The overall bias is bearish and price could continue going downwards, reaching the demand levels at 109.00 and 108.50. Rallies in the market can be taken as opportunities to sell short at better prices.

EUR/JPY: This pair made some bullish effort on August 22, 2017, while the major bias remains bearish. Unless price goes above the supply zone at 130.00 (which could threaten the current bearish bias), it is expected to drop from here, testing the demand zones at 126.50 and 126.00, even going lower than that.