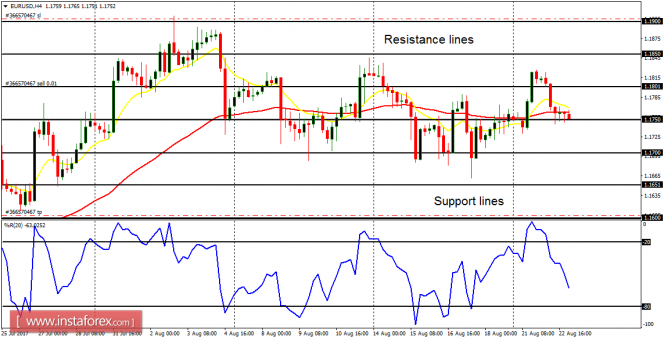

EUR/USD: The EUR/USD is still consolidating. A breakout that can put an end to the current neutrality would happen before the end of this week, and that could make the price go above the resistance line at 1.1900 or below the support line at 1.1650. A movement to the downside is more likely, but the support line at 1.1750 ought to be breached to the downside first (it has been tested many times without being broken).

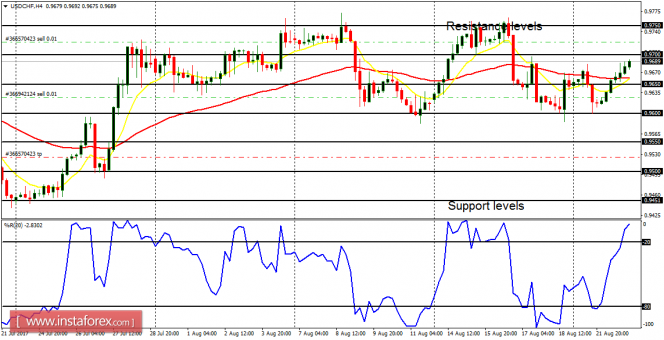

USD/CHF: Although the price tried to go upwards on Tuesday, it can be said that the market remains in a consolidation mode. For the current neutrality to end, the price would need to, either go above the resistance level at 0.9750 or below the support level at 0.9600. Either of this would happen within the next several trading days and it would require strong volatility.

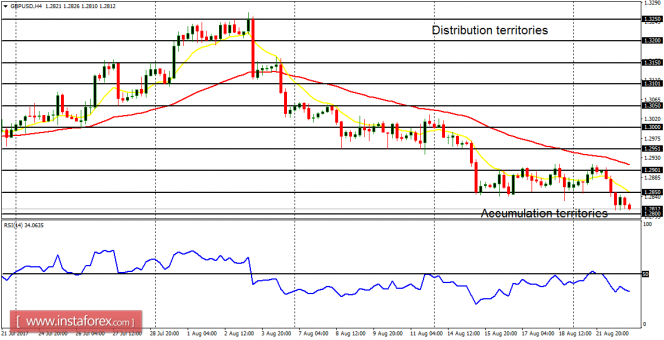

GBP/USD: After moving sideways on Monday, the Cable moved further downwards, as it has been anticipated. Price is below the distribution territory at 1.2850, going towards the accumulation territory at 1.2800. There is a Bearish Confirmation Pattern in the market, so this bearish journey would continue.

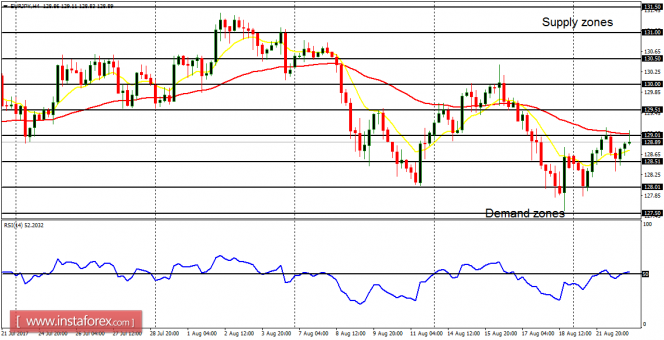

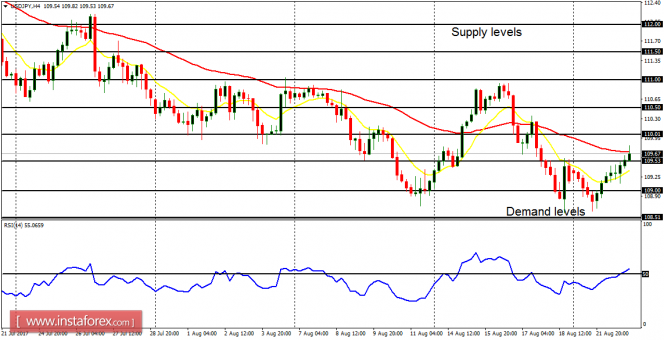

USD/JPY: This currency trading instrument has been making some commendable bullish effort this week. Unless price falls from this point to help lay more emphasis on the extent bearish bias on the market, there would be a threat to the bearish bias once the supply level at 110.50 is breached to the upside.

EUR/JPY: There are mixed signals on the EUR/JPY. The EMA 11 is below the EMA 56 (a bearish indication), but the RSI period 14 is above the level 50 (a bullish indication). One would need to wait to see which direction the market would go in the next few days.