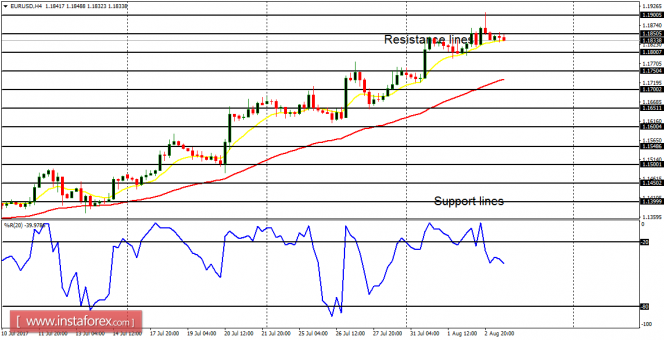

EUR/USD: The EUR/USD is a bull market. The EMA 11 is above the EMA 56, and the Williams' % Range period 20 is not far from the overbought region. Further upwards movement is anticipated when volatility returns to the market. The resistance line at 1.1900, which has been tested before, may be tested again.

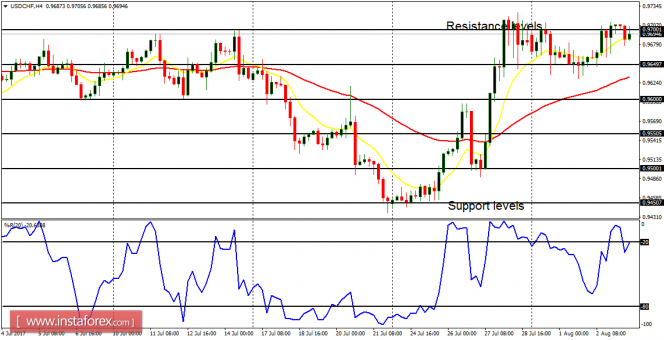

USD/CHF: The USD/CHF has gone sideways so far this week, while the bullish signal that was generated last week is intact. As long as CHF is weak, the bullish signal in the market would be sustained. Some fundamental figures are still expected today, and they may have an impact on the market.

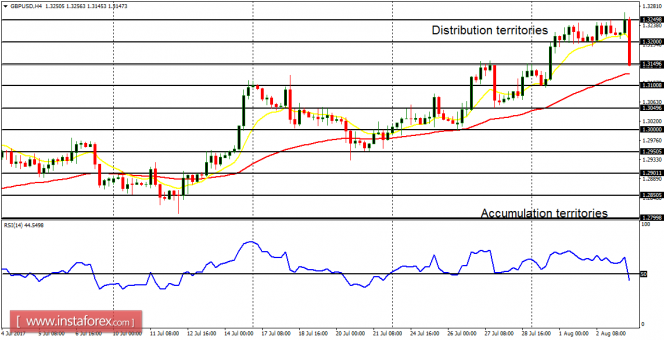

GBP/USD: The GBP/USD is currently experiencing a pullback – in the context of an uptrend. Price is now close to the accumulation territory at 1.3150 and it may breach it to the downside as another accumulation territory at 1.3100 is targeted. However, this is not enough to render the uptrend invalid because the price could go upwards from here.

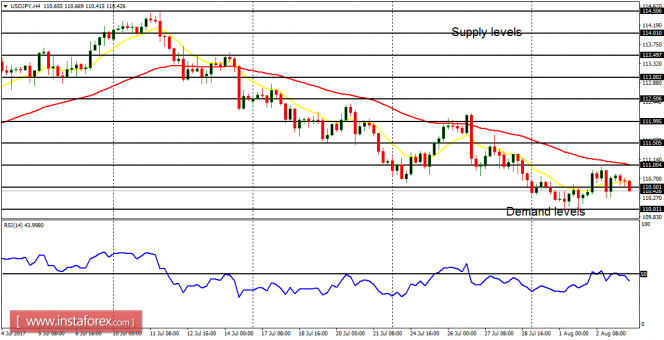

USD/JPY: This is a weak market – though it has not gone seriously downwards this week. It is anticipated that the market would go further downwards in a slow and steady manner, reaching the demand level at 110.00. The demand level may even be breached to the downside, as the market goes on southwards. There is a Bearish Confirmation Pattern in the market.

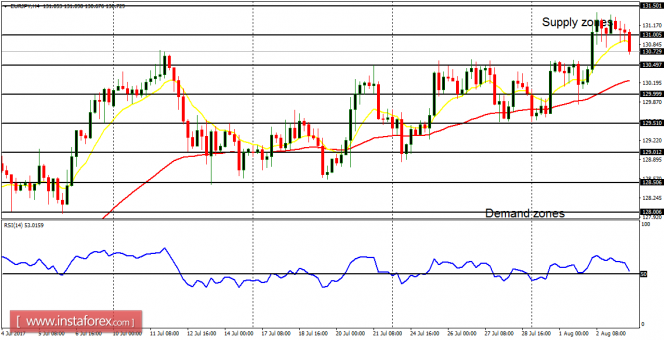

EUR/JPY: This cross has gone above the demand zone at 130.50. There is a bullish signal here, which is invariably threatened by the bear. A movement below the demand zone at 130.00 would result in a return to neutrality, while a movement upwards from here would help save the ongoing bullish signal.