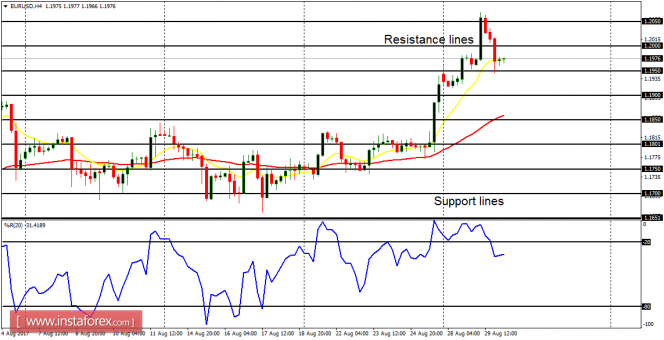

EUR/USD: After a smooth bullish run that was seen earlier this week, there has been a minor correction after the resistance line at 1.2050 was reached, testing the support line at 1.2000. The support line at 1.2000 ought to do a good job impeding further bearish correction, otherwise, it would be difficult for the price to go above it once it is breached to the downside.

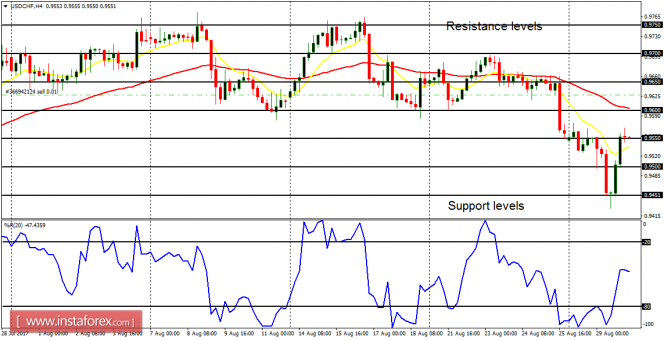

USD/CHF: Following the recent bearish movement on the USD/CHF, there is an upwards bounce, which is expected to offer opportunities to go short at better prices. The support level at 0.9450 was tested before price bounced upwards towards the resistance level at 0.9550. Further bearish movement is expected from here.

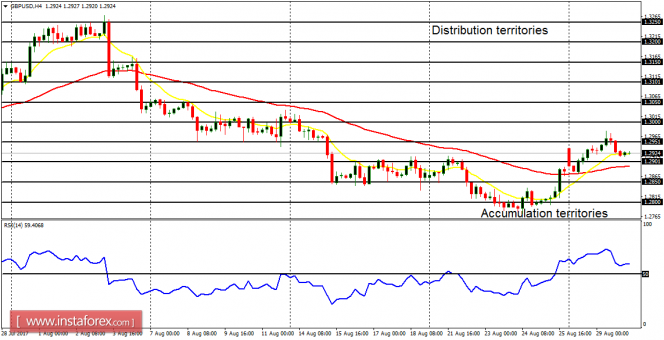

GBP/USD: There is already a bullish signal on the Cable (4-hour chart). The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. Although there seems to be a threat to the bullish signal, it is expected that price would continue going upwards reaching the distribution territory at 1.2950, which has been previously tested. After price goes above the distribution territory, the next target would be another distribution territory at 1.3000.

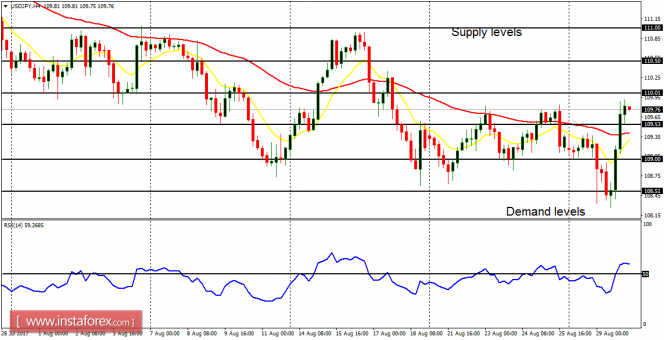

USD/JPY: This pair bounced seriously upwards after testing the demand level at 108.50. This action has become a challenge to the extant bearish bias on the market, and as soon as the supply level at 110.50 is breached to the upside, a bullish bias would be formed. But right now, it is OK to stay on the sidelines until the supply level at 110.50 is breached to the upside or until the price goes downward from here.

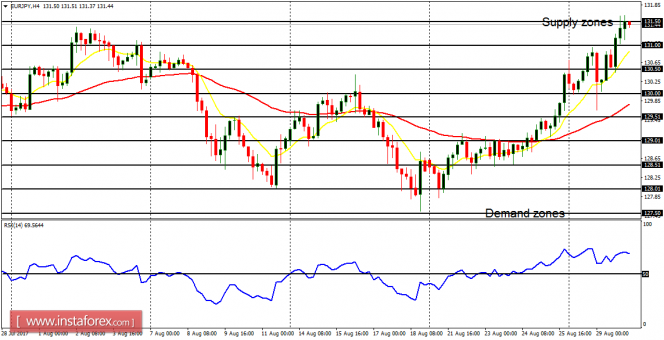

EUR/JPY: The EUR/JPY has generated a bullish signal since last Friday and price has gained about 240 pips since then, now testing the supply zone at 131.50. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. There is a Bullish Confirmation Pattern in the market, and further upwards movement is expected. The next targets are the supply zones at 132.00 and 132.50.