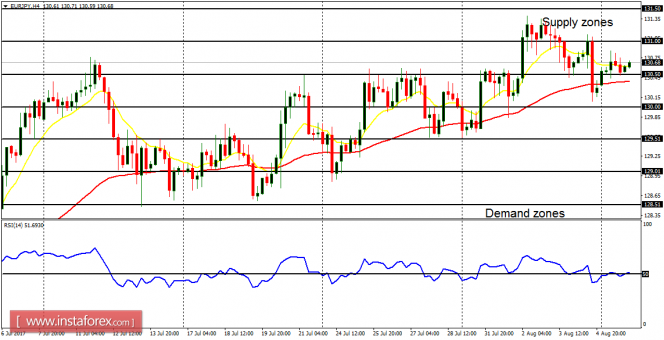

EUR/USD: The EUR/USD did not do anything significant on Monday – price merely went sideways. Last Friday, a drop in price was witnessed. The drop in the context of an uptrend may end up giving a nice opportunity to buy long at better prices. The outlook on EUR pairs is bullish for this week, and the price could go upwards from here, testing the resistance line at 1.1800, 1.1850 and 1.1900.

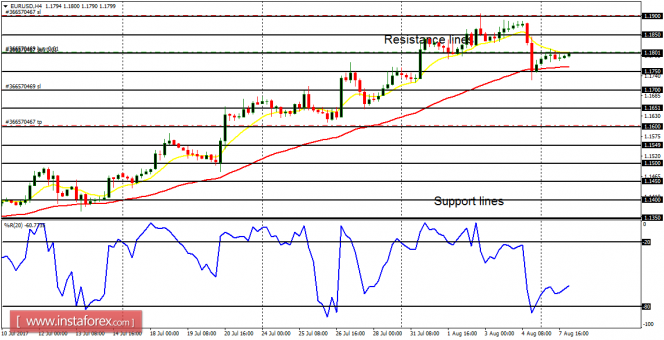

USD/CHF: This currency trading instrument consolidated last week, and it also went sideways on August 7. The resistance level at 0.9750 has been tested and it could be tested again this week, but it is unlikely that it would be breached to the upside. The outlook on the CHF is bullish for the week, and the USD/CHF may experience a downward movement in case CHF becomes strong.

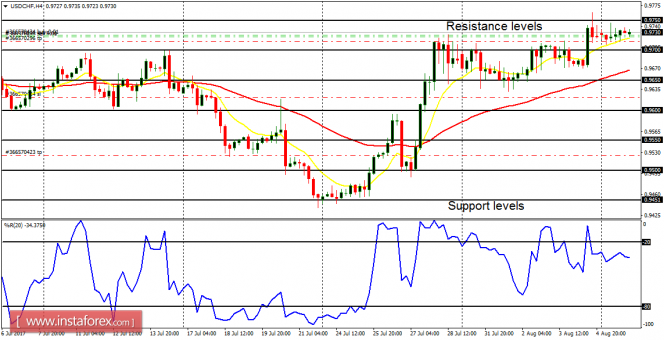

GBP/USD: A clean bearish signal has been generated on the Cable, following the weakness that started last week. From the weekly high of 1.3268, the price has lost about 220 pips, now below the distribution territory at 1.3050. The next target is the accumulation territory at 1.3000, which would most likely be breached to the downside.

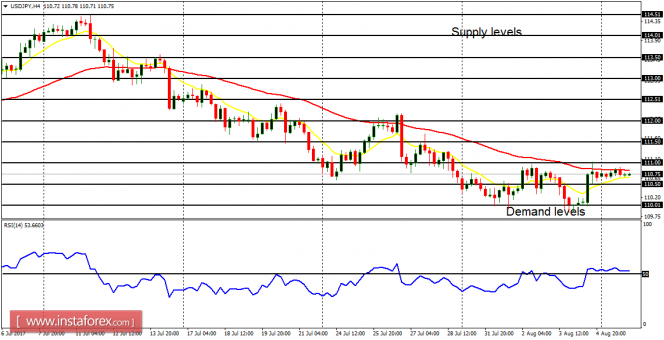

USD/JPY: This is a bear market – price has been going downwards since early July. There is a huge bearish Confirmation Pattern in the market, and the more bearish journey is anticipated this week as price goes for the demand level at 110.50 and 110.00 (both were tested last week). The demand levels may even be exceeded to the downside.

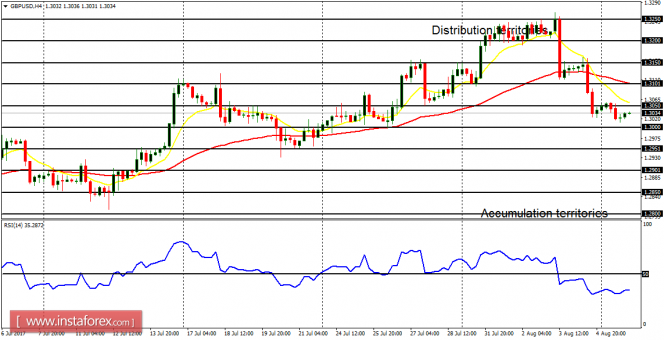

EUR/JPY: The EUR/JPY is neutral, but the neutrality is gradually coming to an end as the price is being subtly pushed upwards. Price has moved above the demand zone at 130.50 and it may even move above the supply zone at 131.00. However, things would go seriously bearish when EUR becomes very week, and when JPY become strong it is its own right.