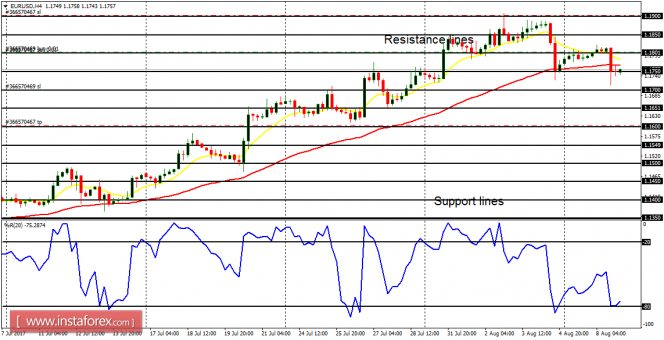

EUR/USD: In spite of the consolidation that has been witnessed in this market so far, the bullish bias remains valid. A movement of about 200 pips to the downside would result in a bearish bias, while a movement of about 100 pips from here would emphasize the extant bullish bias.

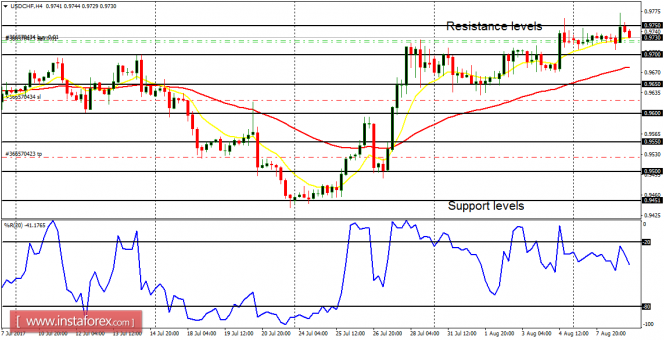

USD/CHF: Ironically, USD/CHF is also bullish, in what can be called a rare positive correlation with EUR/USD. The bullishness was brought about by the strength in CHF, which may be ended as CHF gathers stamina. Right now, there is a Bullish Confirmation Pattern in the market, which would soon be emphasized further or invalided as the USD/CHF goes into a negative correlation with the EUR/USD.

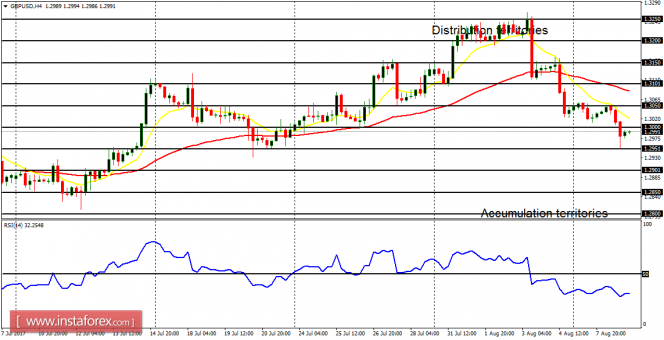

GBP/USD: A clean bearish signal has been generated on the Cable, following the weakness that started last week. The EMA 11 is below the EMA 56, as the RSI with period 14 goes below the level 50. The price has dropped by 100 pips this week, almost testing the accumulation territory at 1.2950. The accumulation territory would soon be breached to the downside as the price goes towards another accumulation territory at 1.2900.

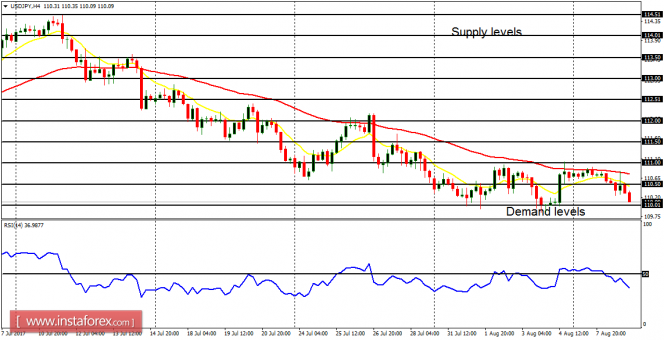

USD/JPY: This pair moved lower on Tuesday, proving that the weak rally that was witnessed on Monday was only an opportunity to sell at better prices. There is a Bearish Confirmation Pattern in the 4-hour chart; plus the RSI with period 14 is below the level 50. Bears are looking forwards to pushing the price towards the demand level at 110.00 (which may even be exceeded as the price goes further downwards).

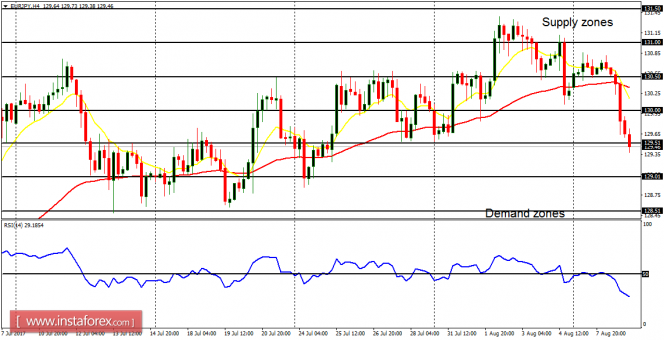

EUR/JPY: After a long period of hesitation – about three weeks – a new bearish signal was generated on EUR/JPY. The price dropped by more than 100 pips yesterday, going below the supply zone at 129.50. The next targets for bears are the demand zones at 129.00 and 128.50, which may be tested before the end of this week.