Strong growth in retail sales in July contributed to the return of demand for the dollar. According to a U.S. Census Bureau report released on Tuesday, sales rose 0.6% in July, well above the 0.4% forecast. Moreover, the June report was also revised upwards, and instead of a 0.2% decrease, we now need to start from an increase of 0.3%.

The evidence suggests that the weakness of the consumer sector is not as deep as previously thought, and revenue growth is sufficient to ensure sustainable demand. At the same time, maintaining a high level of consumer demand is also ensured by the fast growth of household debt. According to the Federal Reserve Bank of New York, the total debt of households in the second quarter was 12.84 trillion dollars, which is 552 billion more than a year ago. These data indicate that citizens are waiting for positive changes that will improve their economic condition in the future, and are ready to spend more, depending on the growth of incomes. At the same time, it is not possible to postpone the reforms because the increase in household debt, according to World Bank research, has a positive effect only in the outlook for the year, after which the reverse dependence is included. An increase in household debt by 1% relative to the GDP leads to a decrease of 0.1% in the long-term outlook.

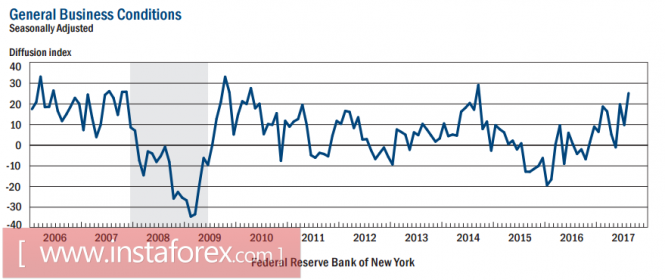

The retail data was not the only positive signal. Import prices rose by 1.5%, which was better than forecasts, while the growth of export prices was 0.1%. The Federal Reserve Bank of New York reported an increase in business activity in the manufacturing sector to 24.2p, which is a three-year high and well above the projected 10.0%.

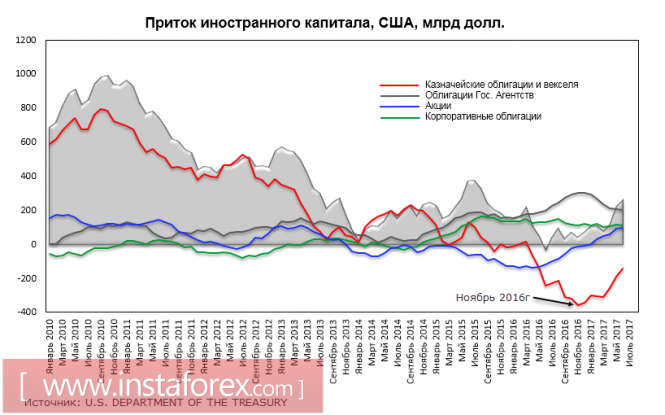

Investors continue to wait for the start of the reform program announced by Trump during the pre-election race. The report of the Treasury on the inflow of foreign capital published yesterday showed that investors are leaving Treasuries. The lowest level was reached in November 2016, after which the demand for bonds is growing every month and should again become positive in the near future. The dynamics of the return of foreign investors in the debt securities of the US government and the stock market indicate a significant potential for confidence in the expected reforms.

Investors are not at all worried regarding the poor collection of taxes, or the devastation of the Treasury's cash desk, nor of Trump's first setbacks in confronting the Congress on medical reform. The expectation of economic growth, asset returns amid rising Fed rates and tax cuts outweigh any concerns.

Strong data releases on Tuesday led to a revision of the forecasts for the interest rate hikes. A few days ago, investors, according to CME, saw a 35.9% probability of another rate increase this year. Then yesterday it rose to 49.5% - a very strong growth in a short period. The volatility is caused, from one side, by the wide spread of estimates in the current situation and of the real state of the U.S. economy. And also, on the other hand, reflects the desire of investors to see a positive program.

The Federal Reserve Bank of Atlanta raised its forecast for US GDP by 3Q to 3.7% on Tuesday, supporting the trend on its expectations for positive changes.

Thus, a number of indirect data indicates a strong deferred demand for the dollar, and the publication of the Federal Reserve's minutes for the July meeting again causes the increased interest. Despite the fact that the meeting was "passing" and was not accompanied by a change in macroeconomic forecasts or a detailed press conference, it is the last before the key FOMC meeting on September 14 and should contain benchmarks for rates and a reduction in the balance sheet.

On Monday, the US president ordered an investigation into China against intellectual property infringement cases. This move was not unexpected, as preparation for it was conducted for a long time.However, this is the first time in many years a real possibility was expressed to use not only Article 301 of the 1974 Merchant Act to unilaterally set barriers for export goods, but also the Law "On International Emergency Economic Powers" from 1977, which gives the US president the right to monitor any economic operations in the event of a threat to national security.

The beginning of active actions will contribute to increased tension and will cause the long-awaited demand for the dollar. Months of correction, which began in January, is nearing its completion.

The material has been provided by InstaForex Company - www.instaforex.com