The US dollar is traded in different directions this week. Investors are waiting for the Fed's symposium in Jackson-Hole to begin where several central bank executives, in particular, the head of the Federal Reserve Bank Janet Yellen and ECB head Mario Draghi, are expected to disclose plans for changing the monetary policy and assessment Economic situation in the world as a whole.

Most likely, there will not be anything new in the public speeches although the press conference promises to be more informative. Yet, it will be difficult to avoid critical issues.

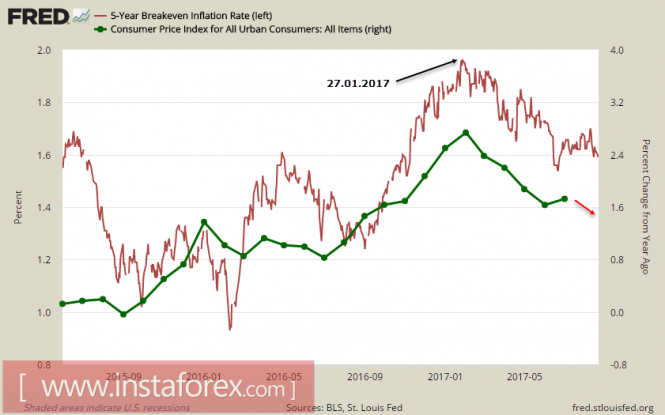

The major concerns for the Fed include the consistency of the planned actions, the resilience of labor market recovery and the real economic situation which is primarily the inflation.

According to the latest employment reports, the labor market remains strong with the growth rate of new jobs remains high while the unemployment dropped low by 4.3% for long-term. The part-time employment is decreasing, and the number of vacancies is growing.

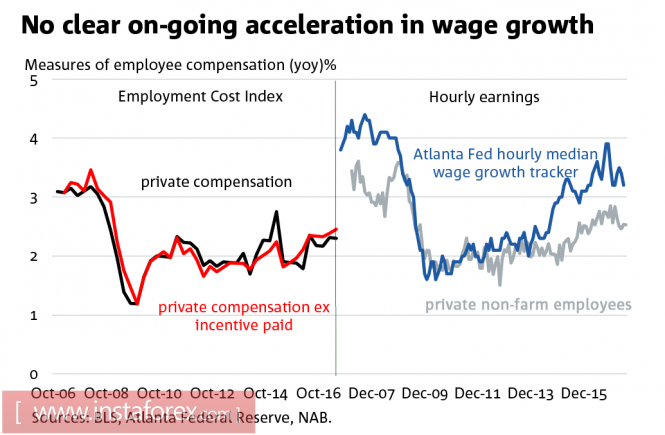

Moreover, the growth of the labor market did not lead to an increase in the average wage. The growth in the average hourly earnings in the non-agricultural sector has not increased with inflation since the beginning of 2015. A similar index from the Federal Reserve Bank of Atlanta also shows modest results.

The trend is quite alarming considering the long-term plans of the Fed - a weak increase in average wages creates insufficient inflationary pressures to withstand the announced growth rates of the discount rate. As a result of the June meeting, the Fed announced target rate of 1.4% in 2017 and 2.1% in 2018, which implies 3 increases this year and in the next.

However, investors are more and more negative.

The situation requires a quick resolution. In September, the US Congress should consider the budget release for the next financial year, and a decrease in consumer activity can significantly complicate the collection of taxes. On Tuesday, several media reported about two different subject matter regarding consultations of the Trump administration and key figures in the Congress that led to an interim success. The parties managed to agree on some parameters of the future tax reform, in particular, the issue of covering the declining income due to lower income tax. In other words, the Congress and the presidential administration found sources in financing the budget deficit. If Trump promises to announce this to the general public, the dollar will be able to receive substantial support against a background of lower political risks.

Against the backdrop of news expectations from Jackson-Hole, the actual macroeconomic news should not be forgotten. Today, Markit will present preliminary business activity data for the month of August. A rapid growth occurred amid a backdrop of tax reform expectations after it lost its momentum during the presidential election. Also, the indices fell back down from the maximum values, but are still at high levels. The period of uncertainty is about to an end. Experts predicted a bit of improvement over July, which may support the dollar.

Data on long-term orders for the month of July will be released on Friday. According to experts, pressure on the volume of orders could fall by 5.5% compared to June because of a slowdown in consumer demand and weak revenue growth.

The dollar has been on a prolonged weakness however, growth is far-fetched as long as the data remains strong.

The material has been provided by InstaForex Company - www.instaforex.com