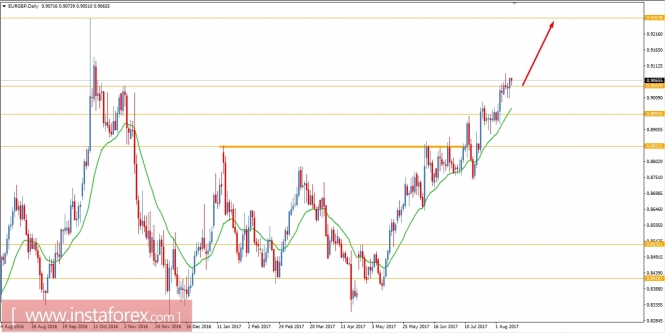

EUR/GBP has been in a non-volatile bullish move after breaking above 0.8850. Recently the price has also broken above the resistance level of 0.9050 which signal further bullish pressure in this pair for the coming days. GBP has been quite struggling with the economic reports for past few days for which EUR has been quite stronger in comparison and currently have steady gains over GBP. Recently GBP Manufacturing Production report was published as expected at 0.0% from the previous value of -0.1% which was not much of a change for the currency and Goods Trade Balance showed greater deficit at -12.7B from the previous figure of -11.3B which was expected to be lower to -11.0B but the increased negative outcome has affected the GBP badly and for which GBP lost some more grounds against EUR. Today EUR German Final CPI reports was published with an unchanged value at 0.4%, German WPI showed negative outcome at -0.1% from the previous value of 0.0% which was expected to increase to 0.3%, French Final CPI report was also published with unchanged value at -0.3% and French Prelim Non-Farm Payrolls report published with an increased figure at 0.5% which was expected to be unchanged at 0.4%. To sum up, today EUR had mixed economic reports which have already lead to corrective structure in the market but still, EUR is expected to gain further over GBP in the coming days as Rate hike sentiment of ECB is still in place.

Now let us look at the technical view, the price is currently residing above the 0.9050 level which indicates further bullish move with a target towards 0.9270. As the trend is non-volatile and the price has been respecting the dynamic level of 20 EMA quite well so the bullish bias is expected to continue further in this pair as the price remains above the 20 EMA and 0.9050 level with a daily close.