The XAU / USD pair climbed to the its highest since the US presidential elections. The silence of central banks and the escalation of the conflict in the Korean peninsula have allowed prices of gold futures to soar.

The silence of central banks and the escalation of the conflict in the Korean peninsula have allowed the gold futures quotes to soar to the maximum levels since the presidential elections in the United States. At the end of 2016, precious metal lost about 10% of its value on expectations of overclocking of the US economy to 3%, thanks to the stimulant programs of Donald Trump. In reality, everything turned out differently. This allowed prices to grow by 15.4% since the beginning of the year.

Just a week ago, BofA Merrill Lynch put out a forecast of $ 1,400 per ounce on the backdrop of the inability of presidential initiatives to pass the Congress, reducing the likelihood of monetary tightening of the Fed and the escalation conflict over North Korea. The first two factors were presented as workers, but it was hard to believe in the resuscitation of geopolitical risks. The the conflict between Washington and Pyongyang was extinguished very quickly. This made it possible for the parties involved to talk about the existence of a backstage agreement. Nevertheless, the joint exercises of the United States and South Korea were not without the attention of its northern neighbor. For the first time since 1998, a ballistic missile flying over the territory of Japan reminded everybody that without the participation of the US, geopolitical risks remain and, most likely, will remain elevated.

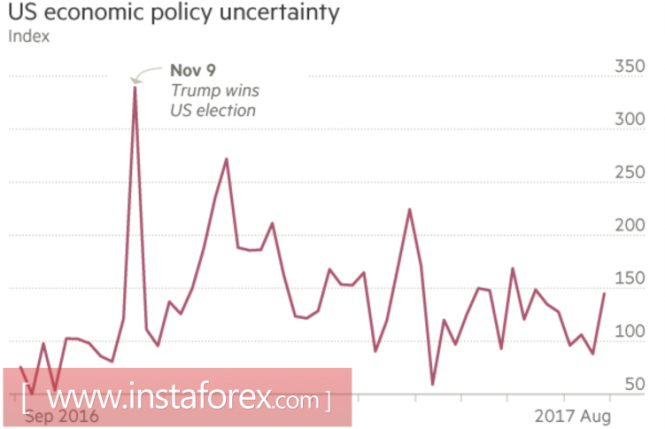

However, there is still the problem of the national debt ceiling, the uncertainty about the tax reforms, and the investigation of Russia's interference in the presidential elections. Political risk in the US continues to creep up, which does not allow the dollar to go into a counter-attack.

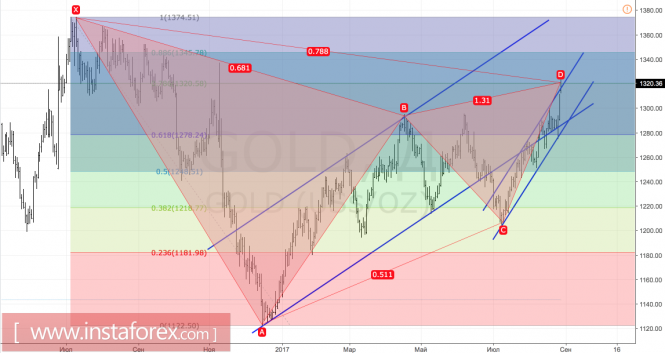

The dynamics of political risks in the US

Source: Financial Times.

Dynamics of gold and the dollar index

Source: Bloomberg.

Add to this the Fed's slowness in raising the federal funds rate, the probability of replacing Janet Yellen with Gary Cohen, and the risks of a weakening US economy under the influence of one the top 10 most expensive calamity, hurricane "Harvey". It immediately becomes clear that investors have many arguments that they can use in order to keep 5-10% of their portfolios in gold. According to the Commission on Commodity Futures, financial managers are the most "bullish" in precious metals over the past 11 months. Their short positions have gone down to the lowest level in 3 years.

It is possible that a strong report on the US labor market will cause some investors to fix profits, which will provoke the rollback of XAU / USD. Nevertheless, positive data from macroeconomic indicators without clarifying the position of the Fed means little. And while Yellen prefers to bypass monetary policy issues in Jackson Hole by not giving any hints regarding a third increase in the federal funds rate for 2017, the US dollar has a hard time.

Technically, gold managed to return to the borders of the previous medium-term upstream trading channel, which indicates the strength of the bulls. As a result of the rapid attack of buyers, an important area of convergence at the range of $ 1320-1325 per ounce was achieved. Here, there is a target of 78.6% for the reversed Gartley pattern and a correction level of 78.6% of the last medium-term downward wave. To continue the northern trend of "bulls", it is necessary to keep quotes above this area.

Gold, daily chart