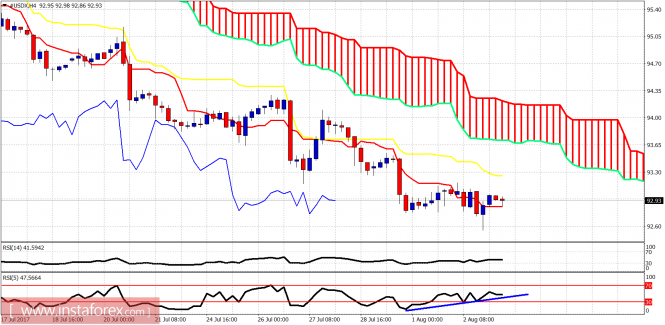

The Dollar index made a new lower low yesterday. The trend remains bearish. There are important bullish divergence signals by the RSI. This is a warning for Dollar bears.

The Dollar index as we mentioned in previous posts, is trading inside the long-term support area of 92-93. Combined with the bullish divergence signs in the daily and 4-hour chart, we should expect a strong bounce at least towards 94.50 if not higher towards the Daily cloud resistance at 96.

The material has been provided by InstaForex Company - www.instaforex.com