Published on Friday, macroeconomic data provoked profit-taking and a noticeable strengthening in the dollar index.

The US trade balance deficit dropped significantly in June due to the growth in exports. The deficit reduction was 5.9% to the minimum since October 2016 which was at the value of $43.6 billion. The result was somewhat unexpected for the market because it is much better than the forecasts. The main reasons that led to positive dynamics are oil export growth and inflation decline against the background of the general weakening of the dollar in the first half of 2017. This had a positive effect on the position of exporters.

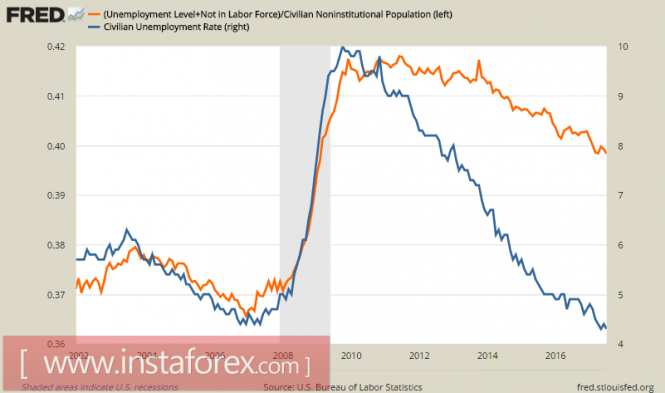

The labor market also showed a positive trend for the month of July. The number of new jobs increased by 209,000. This was unexpected for experts who expected weaker figures after the uncertain ADP report. Moreover, the estimates for May and June were also revised upwards. Unemployment fell from 4.4% to 4.3%, reaching a record low in 16 years.

At the same time, the broader calculation of unemployment, consisting of the total number of unemployed, drop-outs, and the composition of the workforce, is not so convincing. It indicated an unemployment rate of about 8%.

Another positive point in the report was a higher than expected growth in the average wage which increased expectations for consumer activity and other things.

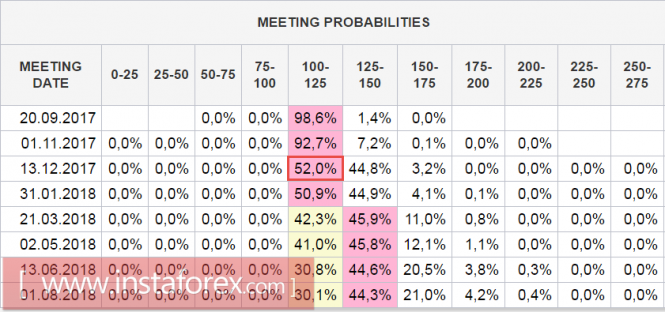

Thus, macroeconomic data played in favor of bulls in the dollar. Technical overselling and the completion of the week supplemented the picture and provoked locking in of profits. At the same time, the confidence that the dollar has reversed did not increase. In any case, the forecast on the rate of CME still gives a 52% chance that the Fed will not raise rates by the end of the year. They will limit themselves to the launch of the balance reduction program.

Similarly, there is no outstripping growth in the yields of US Treasury bonds relative to other G10 securities. That it, there is no question of steady increase in the spread in favor of US securities. Investors are rather cautious about the prospects of the US economy since positive data on exports and the current conditions of the labor market are not strong enough drivers to change the mood of players. There are much more significant factors such as budget revenues and the result of the confrontation between the Congress and the Trump administration regarding the raising of the limit of public debt, medical reforms, and tax reforms.

The coming week, from the point of view of macroeconomic publications, can turn out to be rather calm. The main attention of the market will be turned to the publication on Friday of the report on consumer inflation in July. At the moment, cautious optimism is returning to the markets. Forecasts are generally favorable and it is expected that inflation will show a growth of 0.2%. On an annual basis, experts expect an increase from 1.7% to 1.8%. Positive data can serve as a trigger for the reversal of the dollar index.

On Monday, the Fed will present its assessment of the labor market. July employment indicators, published on Friday, were unexpectedly strong. However, the Fed may have its own view on the general dynamics of the employment market which is different from the market's views and therefore, the publication of the Labor Market Conditions Index on Monday can cause adjustments on the expectations for the rates.

On Wednesday, preliminary data on the labor productivity and labor costs in the second quarter will come out, This will complement the overall picture of the state of affairs in the US economy.

The dollar somewhat strengthened its positions. The probability of growth in corrective moods has increased. At the same time, the reasons for a new wave of strengthening the dollar are not enough. So, the most likely scenario for the coming week is the resumption of a decline in the dollar primarily against the euro and the commodity currencies.

The material has been provided by InstaForex Company - www.instaforex.com