Trading plan for 14/08/2017:

The Asian stock market starts the week with gains after no news regarding the US-North Korea conflict were published during the weekend. The Hang Seng rises slightly more than +1.0% while the Shanghai Composite added +0.85%. The yen and the franc stand out in the foreign exchange market, both of them posted the highest growth last week. Gold loses 0.3%, platinum falls by 0.75%.

On Monday 14th of August, the event calendar is light with only the Industrial Production data from the Eurozone on tap. Nevertheless, there were some overnight data that might play a role today. The Retail Sales data from China were at 10.4% which can be considered as a healthy read, and the Industrial Production was at 6.4%. Positive figures came from Japan. Annualized GDP dynamics fell to 4% q/q (2.5% threshold).

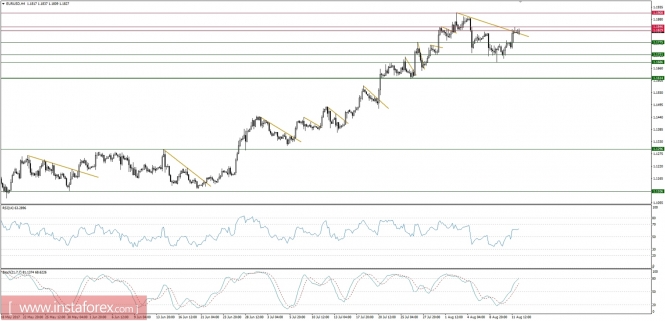

EUR/USD analysis for 14/08/2017:

The Eurozone Industrial Production data are scheduled for release at 09:00 am GMT and market participants expect to fall for the first time in four months. The market consensus forecast sees output slipping- 0.5% for the monthly comparison at the end of the second quarter. This would be the first monthly decline since February and the steepest setback this year. The year-on-year trend will suffer as well, but continue to post modest growth and still rising 2.8% on the yearly basis. The recent set of economic data from the Eurozone was very positive and indicated a steady pace of the economic growth. This is why weakness in today's hard data for June should be considered a temporary pause in an otherwise ongoing recovery for the Eurozone economy.

Let's now take a look at the EUR/USD technical picture on the H4 timeframe. The current corrective cycle from the high at the level of 1.1908 is the biggest and longest one in the sequence of higher highs and higher lows. So far the resistance at the level of 1.1846 - 1.1829 still holds, but better than anticipated data from the Eurozone might challenge the recent top soon. The next important technical support is seen at the level of 1.1614.

Market Snapshot: Gold just below the swing high

Gold is about to challenge the 2-months high at the level of 1296 as the price had broken above the 78%Fibo at the level of $1,277. The market conditions look overbought, but the momentum is still strong and points to more upside gains. The biggest challenge for bulls will be to break out above the resistance zone between the levels of $1,296 - 1,308.

Market Snapshot: GBP/USD in sideways correction

GBP/USD is currently trading inside of the narrow zone between the levels of 1.2932 - 1.3031. The market awaits more data in order to trigger the next move in either direction. Violation of the resistance at the level of 1.3031 opens the road towards the levels of 1.3057 and 1.3111 and violation of the support at the level of 1.2932 may push the price towards the level of 1.2853.