Trading plan for 24/08/2017:

Today the symposium of central bankers in Jackson Hole begins, but the most important speeches will be delivered tomorrow. Meanwhile, market volatility remains very limited. Currency movements do not exceed 0.1%, just like precious metals or oil. The ounce of gold costs $1,289 while WTI is at $48.35.

On Thursday 24th of August, the event calendar is light, but global investors will keep an eye on the second GDP estimate and Business Investment data from the UK, as well as the Unemployment Claims and Continuing Claims from the US.

Analysis of GBP/USD for 24/08/2017:

The second GDP estimate and Business Investment data are scheduled for release at 08:30 am GMT and market participants expect no change in the GDP estimate (0.3% q/q and 1.7% y/y). The Business Investment data are expected to decrease in the second quarter from 0.6% to 0.2% (0.7% to 0.3% on a yearly basis). This drop in positive expectations might find support in a recent study conducted by the UK Recruitment & Employment Confederation (REC). According to the study, the issues like access to labour, Brexit negotiations and political uncertainty are creating nervousness among the employers. This drop in confidence will directly impact consumer sentiment and the GDP growth rate as a result (the consumer spending is an important contributor to the UK GDP). If the UK government chooses the hard-Brexit option, then the sentiment among the business people will drop significantly and it will further affect the EUR/GBP rate which is already at the very elevated levels.

Let's now take a look at the EUR/GBP technical picture on the daily time frame. The price is trading very close to the 10 month's high at the level of 0.9268 and it looks like it will test this level again. Market conditions are extremely overbought at this time frame, but the momentum remains strong. The next technical support is seen at the level of 0.9144, but the drop to this level might be only a short-term pullback, not a change in trend. If the level of 0.9268 is clearly violated, then the next technical resistance will be seen at the level of 0.9410.

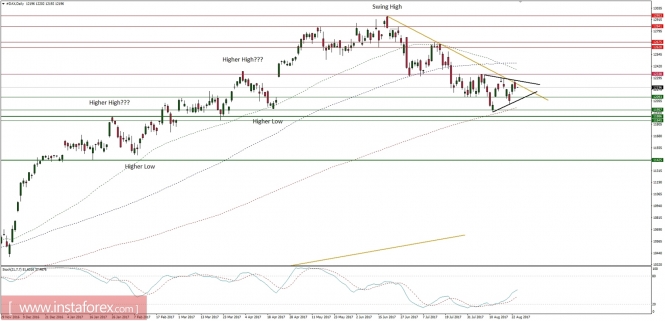

Market Snapshot: DAX fails at the trend line again

The German DAX failed to break above the trend line resistance around the level of 12,266 and it was rejected. Currently, the price is trading in some form of a triangle pattern as traders are waiting for a breakout in either direction. The oversold market conditions are supporting the bullish bias, but bulls are too weak to break out higher above the key technical resistance at the level of 12,338.

Market Snapshot: Gold in the triangle

After a failure at the level of $1,300, gold dropped towards the technical support at the level of $1,280 and now is trading inside of a triangle formation. As long as no new low is made below the level of $1,280, the outlook remains bullish.