Eurozone

ECB President Mario Draghi, speaking at the symposium of the Fed in Jackson Hole, said that he saw no reason to abandon the current rules of financial regulation, thus supporting the position of Janet Yellen. Both central banks are going, by all indications, continue to pursue a coordinated policy.

From Draghi's speech, it follows that the removal of stimulation in the eurozone is premature, and the euro has reacted with an increase.

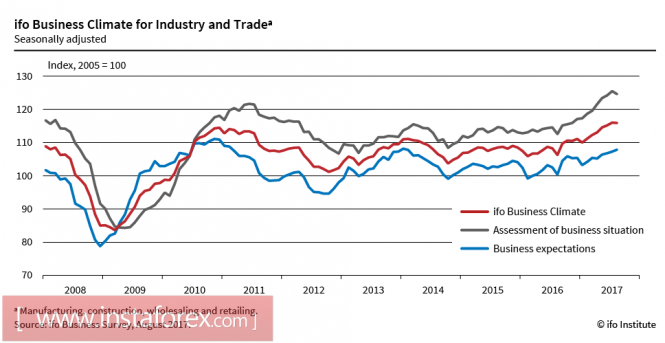

At the same time, a number of key indicators indicate that the stimulus has already played a role. The index of business optimism from IFO fell in August to 115.9p against 116p a month earlier, but still at a record high level. The German economy is growing steadily and there is no sign of cooling.

That fact is the confirmation of the strong growth in the eurozone economy. The highest growth rate of consumer lending since 2009 has also been recorded this year. On Monday, the data for July will be published, and there is reason to expect that an increase in lending will be shown again.

On Tuesday, GfK will present its version of consumer confidence studies in Germany, on Wednesday the European Commission its own, and Thursday will be the most busy day of the week - the report on retail sales and the labor market in Germany for July, as well as the preliminary value of consumer inflation in the eurozone in August will be published. At this point the forecasts are cautious, as experts do not see reasons to wait for inflation growth at the moment. On Friday, Markit's business activity indices will be published, but they are unlikely to have a significant impact, as the market will wait for a report on employment in the US.

Beginning Thursday, a week of silence will start before the ECB meeting on September 7. Attention will be focused on possible leakage of information about future decisions of the regulator. Economic reasons for the decline of the euro is almost none, the euro will hold a week favorite, it is possible to try to reach 1.2030 / 50.

United Kingdom

The main factor that will put the pressure on the pound is still the negotiations regarding Brexit. While the situation is far from a compromise, the discussion of a new trade agreement, scheduled earlier in October, is postponed indefinitely. The pound can get a long-awaited driver for growth, especially paired with the euro, only if negotiations make progress and with a reasonable amount of British debt for exit from the EU.

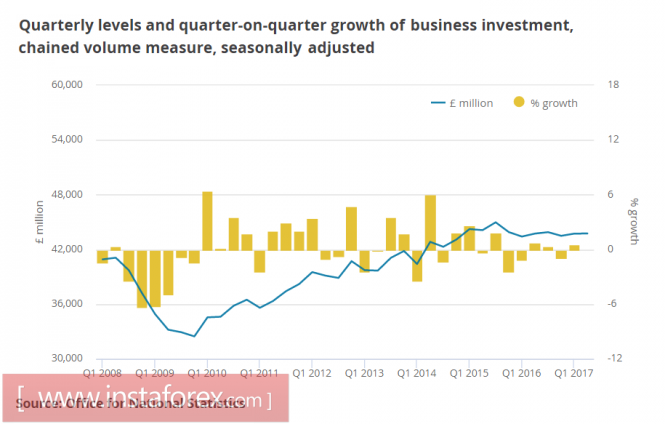

The macroeconomic data released last week turned out to be weak. The growth of commercial investments in the second quarter turned out to be zero, as investors are in no hurry to finance the UK economy until clarity on Brexit appears.

On Wednesday, interest will be caused by the publication of consumer expectations in August from Gfk. A decrease to -12p a month earlier was the lowest since 2013, and experts expect the index to worsen to -13p. On Friday, there is the PMI index from Markit and the expectations are neutral.

The pound remains under pressure even against the weak dollar, and increase attempts will be limited to the level of 1.30, more likely to decline by the end of the week to 1.2650.

Oil

The OPEC camps are preparing for the next meeting, which will be held on September 22 and will be held in an expanded format. At the meeting, at the request of the organizing committee, "all options" will be considered, including an additional reduction in production. Long-term is a bullish factor for oil, as is the slowdown in production in the US due to the rapid growth of accumulated debt by shale companies that are unable not only to make a profit, but also to pay debts at current prices.

The report of Baker Hughes, according to which the number of oil wells decreased last week from 763 to 759, was ignored because the focus was on the consequences of the hurricane and the Fed symposium.

The material has been provided by InstaForex Company - www.instaforex.com