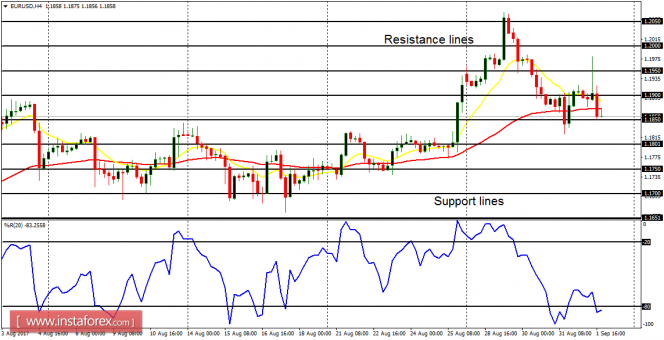

EUR/USD: This pair is bullish in the long-term, but bearish in the short-term. Although price made some bullish effort last week, rising upwards to test the resistance line at 1.2050 (before about 200-pip correction), we could see further bearish movement this week. Some bullish effort is also possible, but it would be contained at the resistance line at 1.2050.

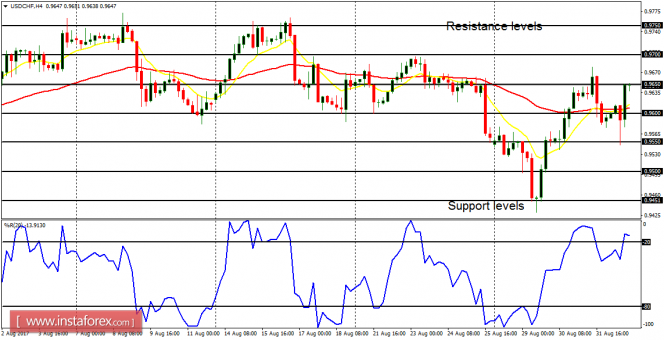

USD/CHF: This currency trading instrument has been consolidating for about 5 weeks – hence a neutral outlook on the market. There is going to be a rise in momentum this week, which would result in a Bullish Confirmation Pattern (when price gains about 150 pips), or it would result in a Bearish Confirmation Pattern (when price loses about 150 pips).

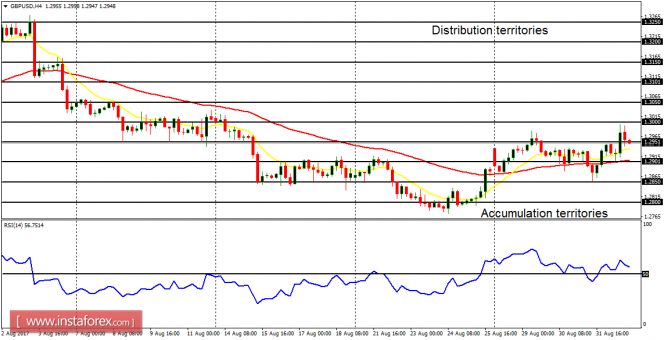

GBP/USD: The GBP/USD is bearish, although price merely consolidated throughout last week. A closer look at the market reveals a possibility of a bullish movement that may enable price to test the distribution territories at 1.3000 and 1.3050. Alternatively, the price could go further downwards from here, leading to more emphasis on the recent bearish outlook.

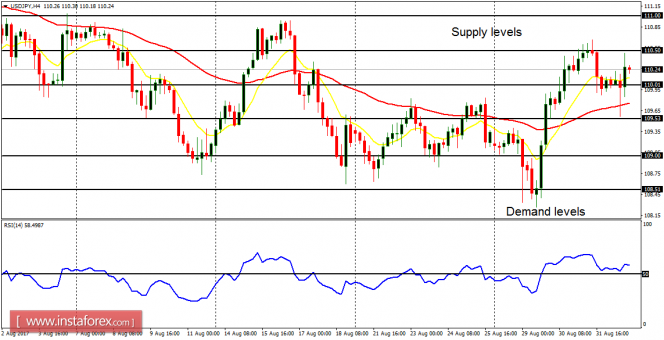

USD/JPY: This market is neutral (in spite of what happened last week), having consolidated for about a few weeks. A directional movement would happen this week after the price goes below the demand level at 108.50 or it goes above the supply level at 111.00. That is the expectation for this week.

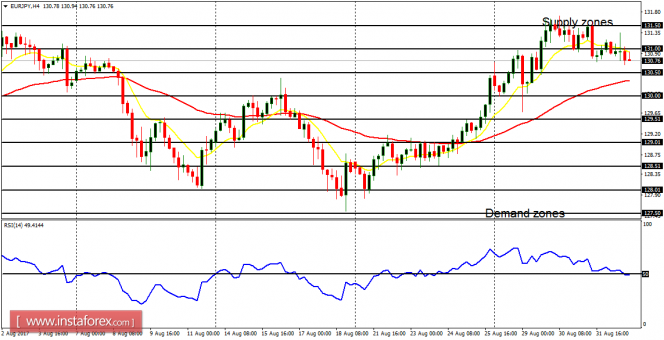

EUR/JPY: The EUR/JPY is bullish. The price went upwards last week, to test the supply zone at 131.50 before it got corrected by 70 pips, to close below the supply zone at 131.00 on Friday. The movement of the market this week would be determined by whatever happens to Yen. Continuous weakness in Yen would enable price to reach the supply zones at 131.00, 131.50 and 132.00. Should Yen show a measure of stamina, the EUR/JPY would go downwards by around 200 pips.