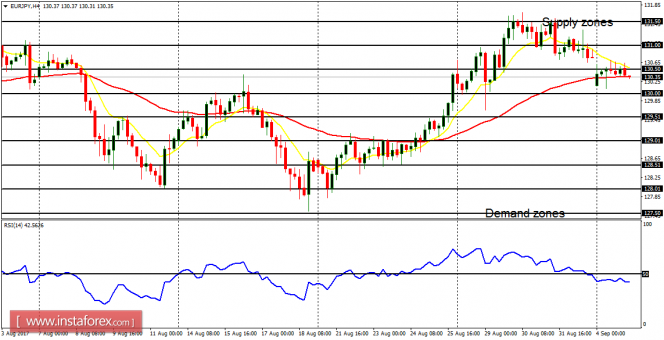

EUR/USD: This pair moved sideways on Monday. The bullish signal in the market is still valid (unless price goes below the support lines at 1.1750). It is possible that when momentum returns to the market, it would most probably favor the current bullish signal, and thus, the resistance lines at 1.1950 and 1.2000 could be reached.

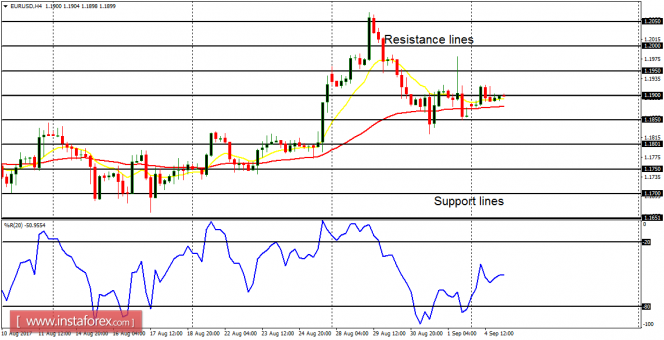

USD/CHF: This currency trading instrument has been consolidating for about 5 weeks – hence a neutral outlook on the market. There is going to be a rise in momentum this week, which would result in a Bullish Confirmation Pattern (when price gains about 150 pips), or it would result in a Bearish Confirmation Pattern (when price loses about 150 pips).

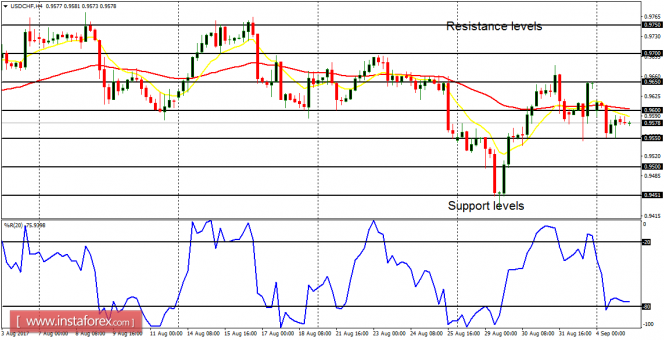

GBP/USD: The GBP/USD pair consolidated on September 4 with no significant movement to the upside or the downside. The market has been consolidating since last week, in the context of an uptrend. However, a breakout is imminent, which would most probably favor bears. The accumulation territories at 1.2900 and 1.2850 would soon be tested.

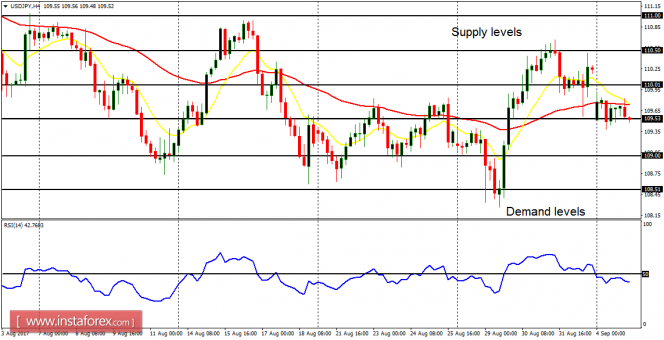

USD/JPY: This market is neutral in the medium term, but bearish in the very short term. Yesterday, price trended lower, and further downwards movement could result in a bearish signal (especially when the support level at 109.00 is broken to the downside). A rally from here would force price back into the neutral zone.

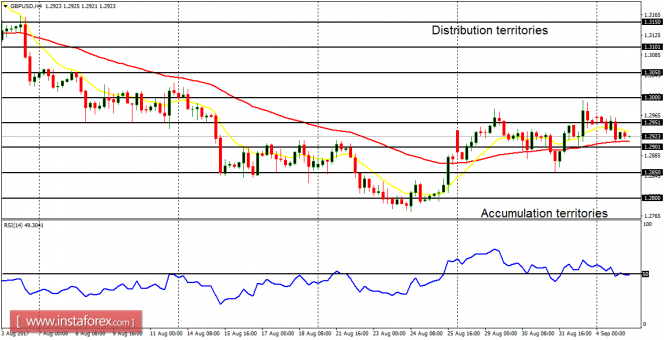

EUR/JPY: The EUR/JPY cross opened this week with a minor gap-down and then trended lower. This price action has become a threat to the recent bullish bias on the market, for price has been coming down since it tested the supply zone at 131.50 last week (a drop of 110 pips). A further drop in price would ultimately lead to a bearish signal.