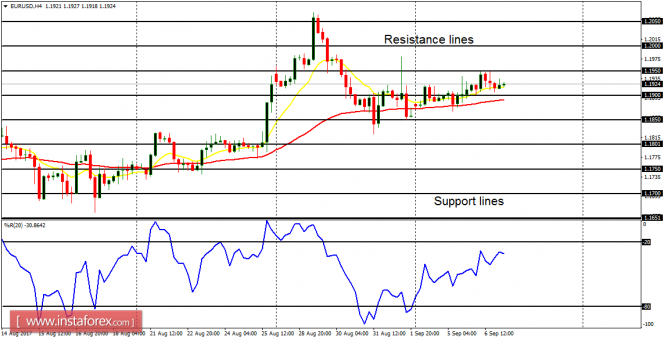

EUR/USD: This pair continues to go sideways and the bias on the market could become neutral in case the situation continues as it is (unless price goes below the support lines at 1.1750). It is possible that when momentum returns to the market, it would most probably favor the current bullish signal, and thus, the resistance lines at 1.1950 and 1.2000 could be reached.

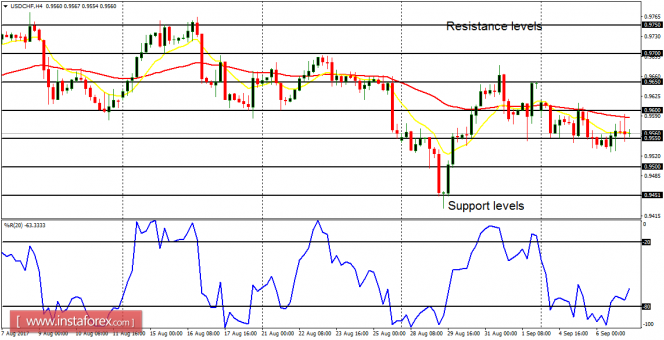

USD/CHF: There is a slight bearish signal on this currency trading instrument. The EMA 11 is below the EMA 56 and the Williams' % Range period 20 is not far from the overbought region. As the EUR/USD pair goes upwards, USD/CHF would go downward, targeting the support levels at 0.9550 and 0.9500.

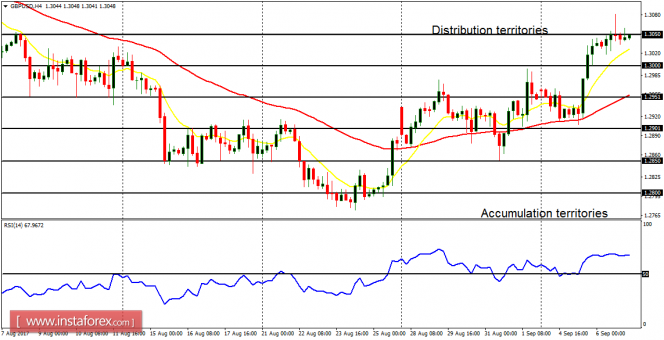

GBP/USD: There is already a bullish signal on the GBP/USD pair. Price has gone upwards by 120 pips this week, and that has resulted in a bullish bias. The distribution territory at 1.3050 is being tested and after it is breached to the upside, another distribution territory at 1.3100 would be the next target.

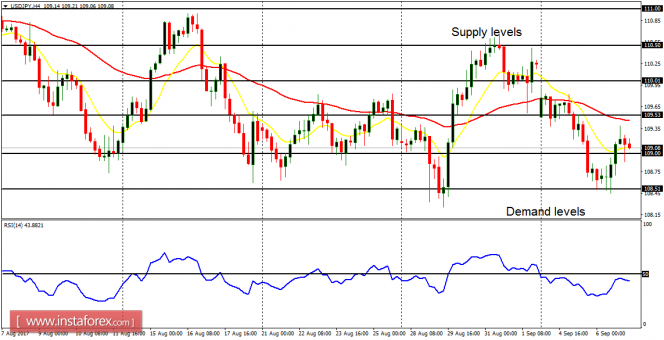

USD/JPY: There is a Bearish Confirmation Pattern on the USD/JPY pair, owing to a smooth bearish run that was witnessed in the first few days of the week. Any rallies that are seen here would be taken as opportunities to sell short at better prices. Some fundamental data are expected today and they may have impact on the markets.

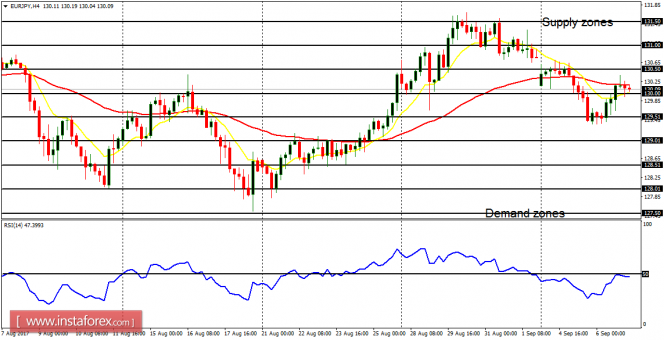

EUR/JPY: This cross is also bearish – though there is a bullish retracement in the context of a downtrend. The current bullish retracement may not be able to override the bearishness in the market unless the supply levels at 131.00 and 131.50 are breached to the upside. Normally, this cross is expected to trend downwards from here.