The Dollar index is showing signs of strength. We mentioned in previous analysis that Dollar bears should be very cautious because we had warning signs of a possible strong bounce in the index. The index is now challenging resistance that if broken could confirm that we are in a bigger bounce towards 96-97. However my main view remains bearish looking for a move below 90 over the coming weeks.

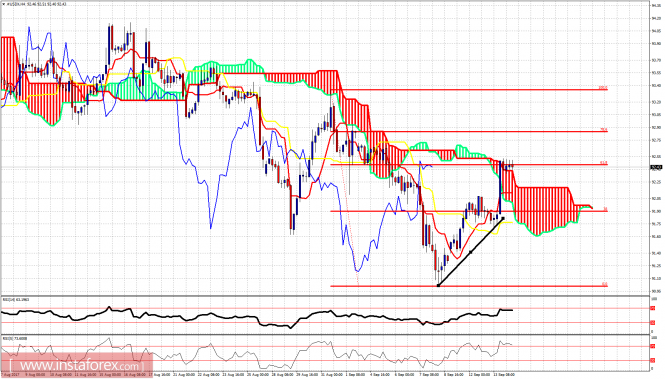

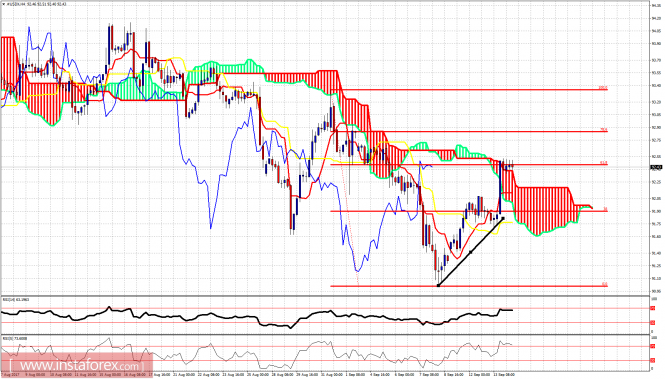

In the 4-hour chart the Dollar index is trying to break out of the Ichimoku cloud resistance. Price is now at the 61.8% Fibonacci retracement of the decline from 93.35. This important Fibo resistance is at the same level with the Kumo. Dollar bulls need to be cautious here for a possible rejection. Support and trend change level for the short-term is at 91.70.

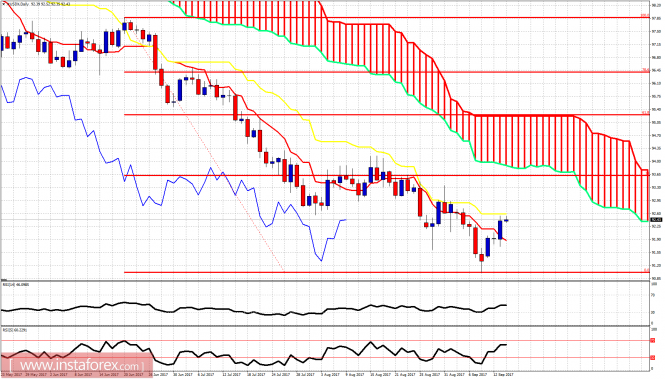

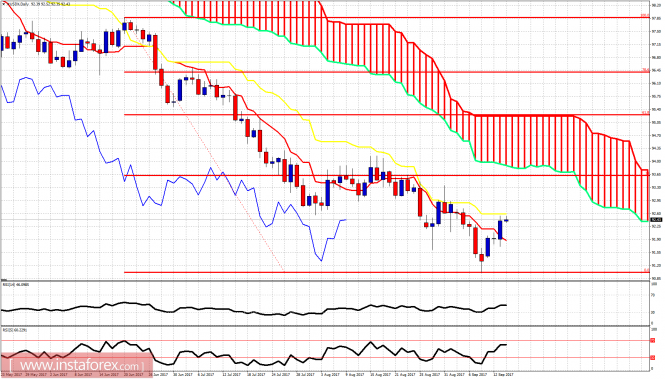

On a daily basis the Dollar index is testing the kijun-sen resistance level at 92.50-92.60. Breaking above this level will push the index towards the lower boundary of the Ichimoku cloud near 93.80-94. As long as the index is above 91.70 the chances of a bigger bounce are higher. However longer-term trend remains bearish and this bounce is considered as a selling opportunity.The material has been provided by InstaForex Company -

www.instaforex.com