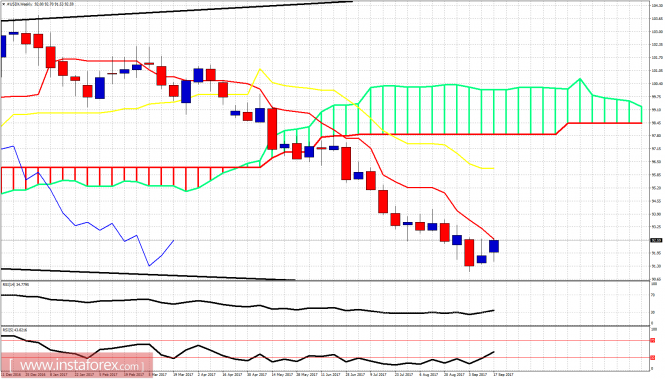

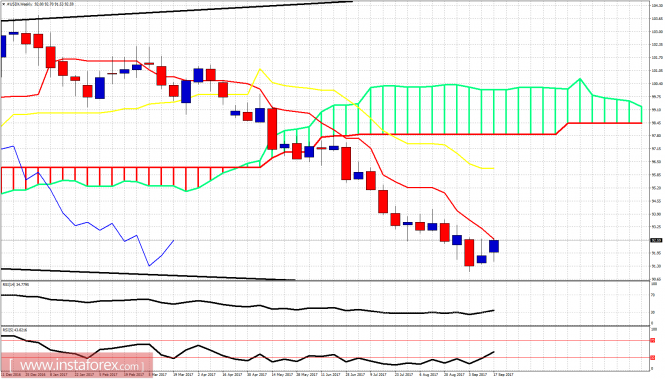

The Dollar index spiked yesterday after the FOMC. Price is testing weekly resistance levels at 92.50. So far we consider this upward bounce as a corrective play in a larger down trend.

In the mean time you can connect with us with via:

Welcome To Money Grows Network

2006 - 2019 © www.moneygrows.net

Investments in financial products are subject to market risk. Some financial products, such as currency exchange, are highly speculative and any investment should only be done with risk capital. Prices rise and fall and past performance is no assurance of future performance. This website is an information site only.

The Dollar index spiked yesterday after the FOMC. Price is testing weekly resistance levels at 92.50. So far we consider this upward bounce as a corrective play in a larger down trend.