Overview:

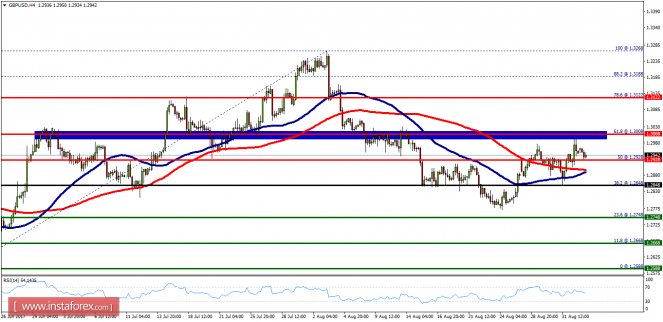

- The GBP/USD pair has fallen from the level of 1.3008, which coincides with the ratio of 61.8% Fibonacci retracement, to the bottom around 1.2848. But it rebounded from the spot of 1.2850 to set at the level of 1.2950 currently. The GBP/USD pair will probably keep moving downwards from the levels of 1.2928/1.3008. The first resistance level is seen at 1.2928 followed by 1.3008, while daily support 1 is found at 0.6817.

- The level of 1.2848 represents a weekly pivot point for that it is acting as minor resistance. Amid the previous events, the pair is still in a downtrend. The GBP/USD pair is declining from the new resistance line of 1.2928 towards the first pivot level at 1.2848 in order to test it. Hence, we recommend selling below 1.2848 with the first target at 1.2748. If the pair succeeds to pass through the level of 1.2748. Then, the market will indicate a bearish opportunity below the level of 1.2748 in order to continue towards the next objectives of 1.2668 and 1.2588.

- On the other hand, if a breakout happens at the resistance level of 1.3008, then you'd better set your stop loss at 1.3028.