Overview:

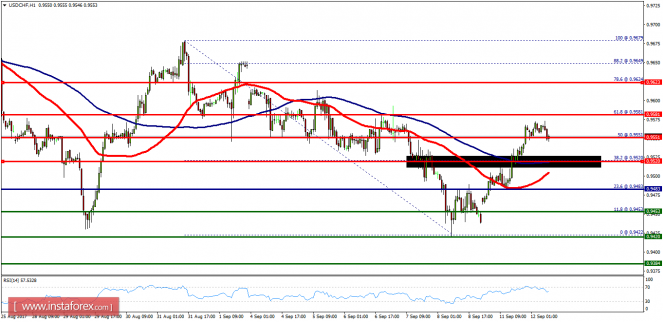

- The USD/CHF pair broke resistance which turned to strong support at the level of 0.9520 yesterday. The level of 0.9520 coincides with a golden ratio (38.2% of Fibonacci), which is expected to act as major support today. The Relative Strength Index (RSI) is considered overbought because it is above 30. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended above 0.9520 with the first target at the level of 0.9581. From this point, the pair is likely to begin an ascending movement to the point of 0.9581 and further to the level of 0.9623. The level of 0.9623 will act as strong resistance and the double top is already set at the point of 0.9679. On the other hand, if a breakout happens at the support level of 0.9483 (horizontal blue line). , then this scenario may become invalidated.