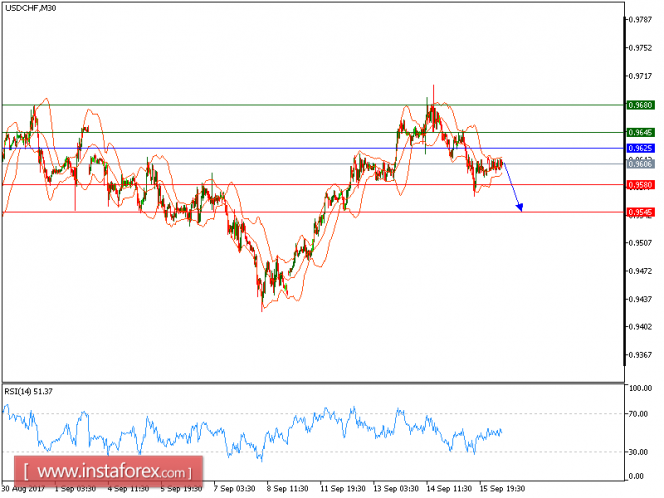

Our first Target which we predicted in the previous analysis has been hit. USD/CHF is expected to trade with a bearish outlook. Although the pair posted a rebound, the upward potential is likely to be limited by the resistance at 0.9625. The declining 50-period moving average is playing a resistance role.

The U.S. Commerce Department reported that retail sales fell 0.2% on month in August (vs. +0.1% expected, +0.3% in July). The University of Michigan Consumer Sentiment Index dropped to 95.3 in August from 96.8 in July.

Hence, as long as 0.9625 is not surpassed, look for another decline to 0.9580 and even to 0.9545 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 0.9625, Take Profit: 0.9580

Resistance levels: 0.9645, 0.9680, and 0.9710

Support levels: 0.9605, 0.9580, and 0.9500

The material has been provided by InstaForex Company - www.instaforex.com