Trading plan for 12/09/2017:

Before the start of the European session, the strongest depreciation is noted on NZD (-0.4%). The Australian Dollar (-0.2%) is depreciated as well, temporarily under pressure from clearly weaker data from business confidence index. EUR/USD is trading close to yesterday's lows around 1.1950. (0.0%) waiting for a clear rise in volatility. On Wall Street, all of the indices closed with modest gains yesterday.

On Tuesday 12th of September, the event calendar is rather light in important economic releases, but during the London session, the market participants will pay attention to set of a Consumer Price Index data. Later on, the JOLTs Job Openings data from the US will be released, together with NFIB Small Business Optimism data.

GBP/USD analysis for 12/09/2017:

The important set of CPI data from the UK economy is scheduled for release at 08:30 am GMT and market participants expect an increase in price pressures from -0.1% to 0.5% for the reported month. On a yearly basis, the inflation should pick up from 2.6% to 2.0%. If the data is released in line with expectations, then market participants will expect hawkish comments in Thursday's BoE statement after the interest rate decision. It means the British Pound might remain in demand across the board, as the market will start to discount the possible interest rate hike in the future. Nevertheless, it is still not clear how much of the statement will be a simple jawboning instead of a clear and simple further guidance from the Bank of England. It looks like the optimism of market participants is starting to evaporate slowly.

Let's now take a look at the GBP/USD technical picture on the H4 time frame. The bulls have managed to break out above the 78%Fibo at the level of 1.3161 but no new high was made so far and the price stalled above the swing high at the level of 1.3267. The market conditions are overbought on this time frame, so the corrective cycle might be triggered soon. The key level to the downside is the technical support at the level of 1.3126 - 1.3111. Break below the golden trend line support is a first clue that bears are taking control over the market.

Market Snapshot: USD/JPY bounces from support

The price of the USD/JPY pair has bounced from the technical support at the level of 107.53 and currently is testing the first zone of resistance between the levels of 109.41 - 109.84. Any breakout above this zone would immediately lead to the test of the important technical resistance at the level of 111.04. Growing positive momentum supports the short-term bullish view.

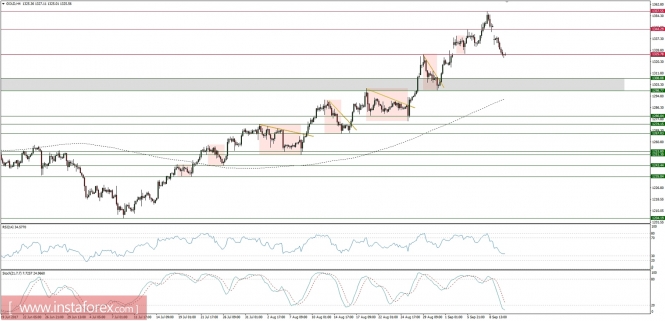

Market Snapshot: Gold retreats from the highs

The price of Gold has retreated from the swing highs at the level of $1,358 and currently is trading at the technical support at the level of $1,325. A breakout lower would lead to testing important support zone between the levels of $1,298 - $1,308. Growing negative momentum supports the short-term bearish view.