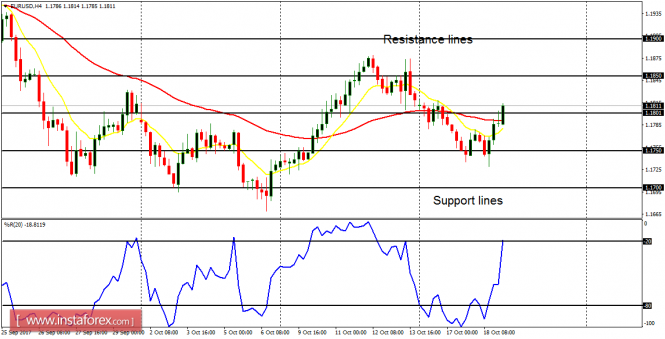

EUR/USD: In the short term, this pair is neither bullish nor bearish. It is thus better to remain neutral until price goes above the resistance line at 1.1850 (staying above it), or it goes below the support line at 1.1700 (staying below it). One of these two conditions would result in a directional bias.

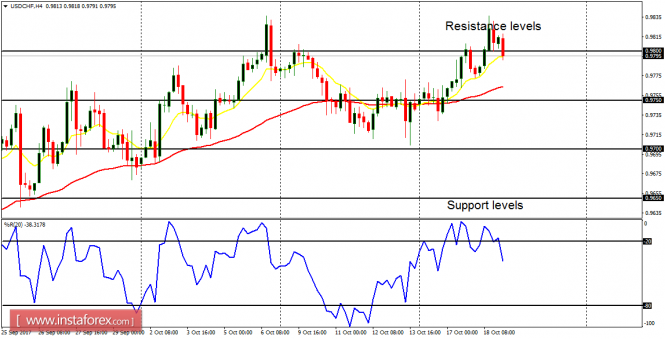

USD/CHF: There is an essential bullish bias on this market, for price has gone slightly upward this week. Further bullish movement is possible, especially when the EUR/USD pair slides southward. The resistance level at 0.9800 has been tested and it can be tested again, as price goes northwards.

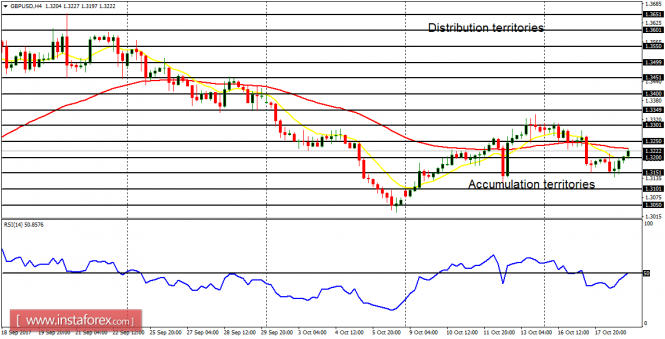

GBP/USD: There is a short-term bearish signal on the GBP/USD pair. Price has moved downwards this week, and it could continue going further downwards, reaching the accumulation territories 1.3150 and 1.3100. Unless the distribution territory at 1.3300 is breached to the upside, the current rally attempt can turn out to be a good opportunity to go long.

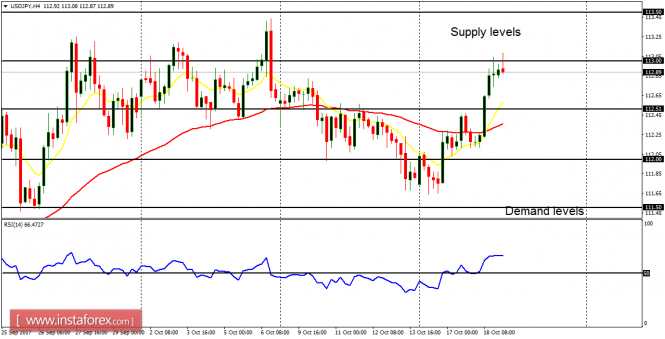

USD/JPY: The USD/JPY pair has gone upwards by 110 pips this week, generating a bullish signal. The EMA 11 is above the EMA 56 and the RSI period 14 is above the level 50. The supply level at 113.00 has been tested and price would soon go above it. Some fundamental figures are expected today and they may have impact on the markets.

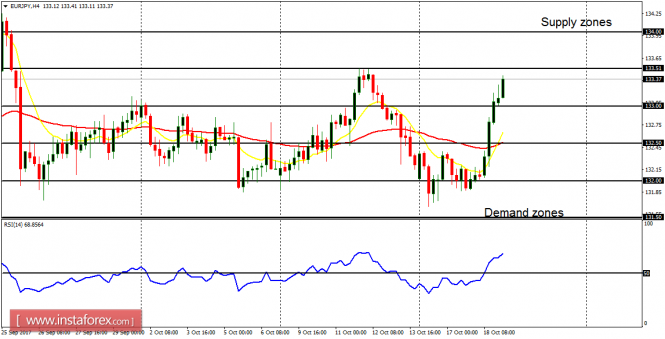

EUR/JPY: There is an interesting bullish signal on the EUR/JPY cross (and so is it on certain JPY pairs). The Yen is being weakened further and thus, this cross is expected to continue going upwards towards the supply zones at 133.50 and 134.00. The supply levels may even be exceeded this week or next week.