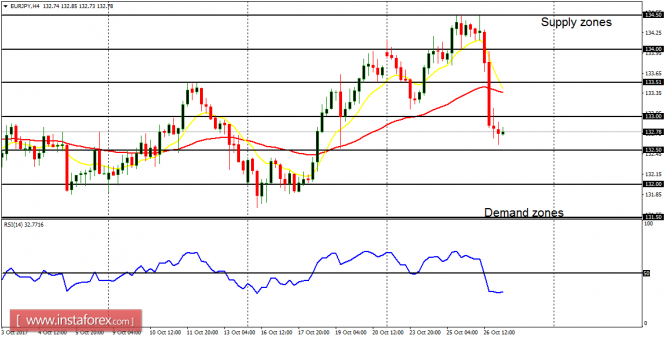

EUR/USD: Following the initial bullish effort that was seen earlier this week, the market plummeted on Thursday, losing 170 pips. Price remains under the resistance line at 1.1650, and it may go towards the support line at 1.1600. Any rallies here would be temporary as price journey further southwards. The bias on the market is now bearish.

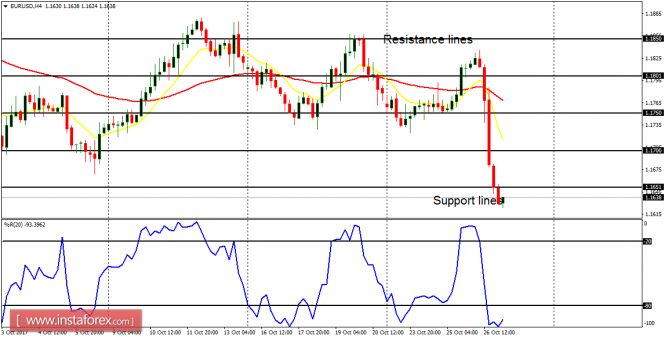

USD/CHF: The USD/CHF has gone upwards this week, gaining 130 pips. Price is now above the support level at 0.9950, aiming the resistance level at 1.0000. It is possible that USD would reach parity with CHF, for this ongoing bullish momentum could propel price towards another resistance level at 1.0050. But it should be noted that the resistance level at 1.0000 is a psychological area and it would not be easily breached to the upside.

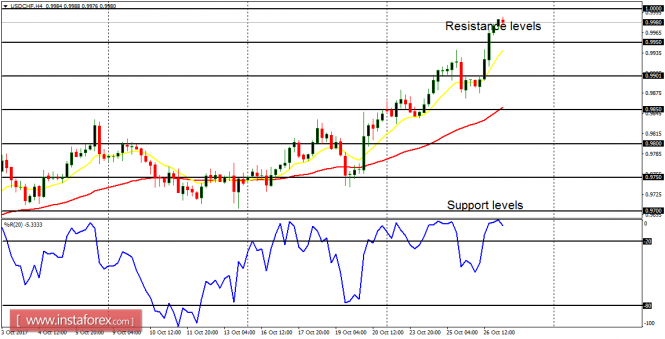

GBP/USD: In fact, the movement of the Cable has been erratic, with no directional movement. There have been short-term bearish and bullish swings in the market, which would continue until price crosses the distribution territory at 1.3300 to the upside, or until price crosses the accumulation territory at 1.3050 to the downside.

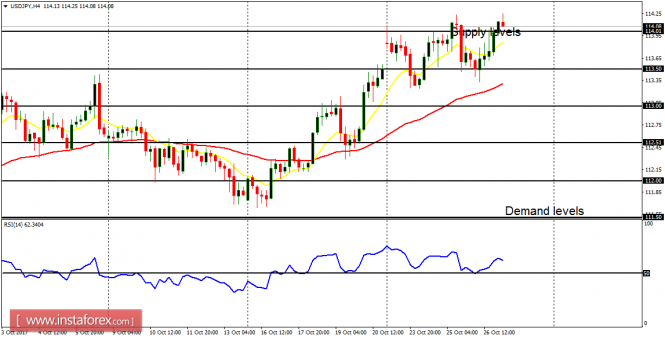

USD/JPY: In spite of bears' machinations, the USD/JPY has continued making a relentless bullish effort (which has paid off). Price has successfully gone above the demand level at 114.00, creating a Bullish Confirmation Pattern in the market. Since USD is currently stronger than JPY, it may be possible for the supply level at 114.50 to be reached easily.

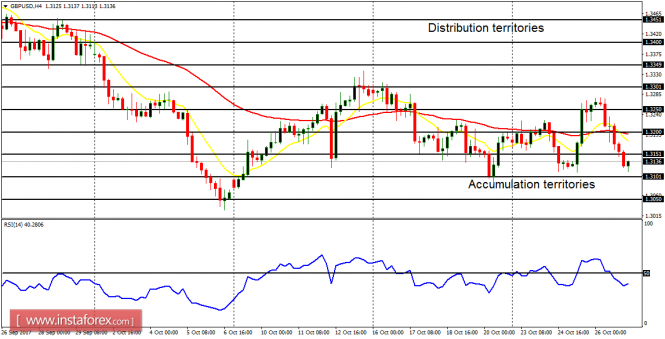

EUR/JPY: In the first few days of this week, this currency trading instrument made attempt to rally, but the attempt was foiled as price tested the supply zone at 134.50. From there, the price plummeted by 180 pips, thus threatening the recent bullish bias. The demand zones at 132.50 and 132.00 could be tested, and by then, the EMA 11 would have crossed the EMA 56 to the downside.