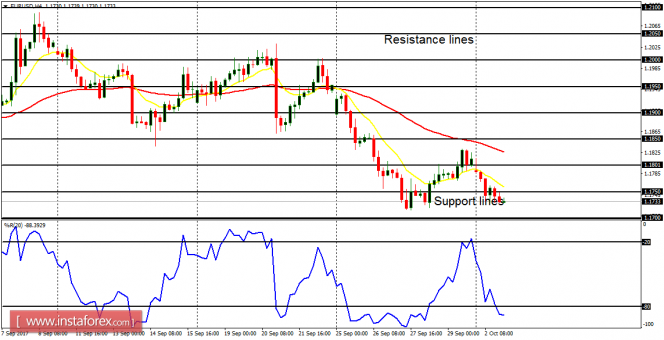

EUR/USD: This pair was pushed lower on October 2, and it is now below the resistance line at 1.1750, going towards the support line at 1.1700 (an initial target). Other targets for bears are the support lines at 1.1650 and 1.1600, which could be reached within the next few days. The outlook on EUR pairs is bearish for this month, and thus, the EUR/USD would go bearish in most cases.

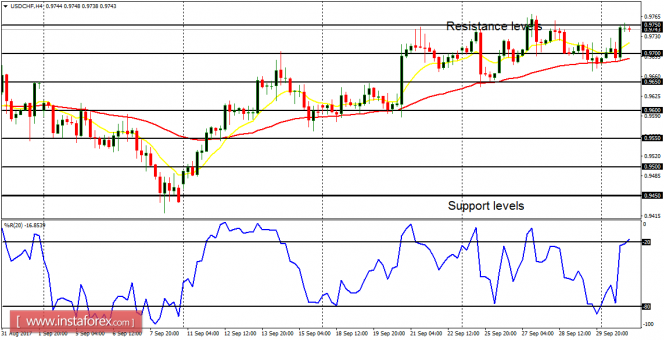

USD/CHF: This currency trading instrument showed some bullishness yesterday – and it is already in a bullish mode. As the EUR/USD goes further south, the USD/CHF will go further north. At first, the northwards journey would seem limited because of some attempts to gather stamina on the part of CHF. However, the bulls would become clear winners by the end of the month, for USD would have gained some strength by then.

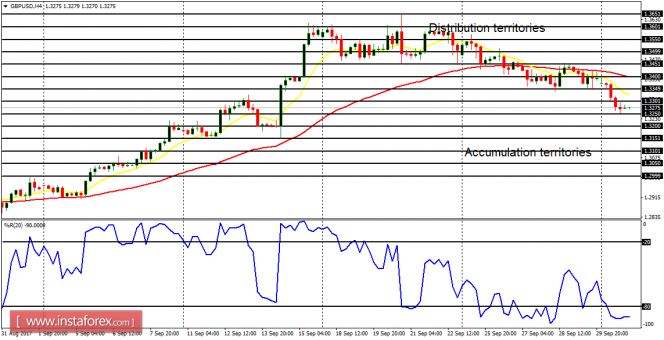

GBP/USD: The GBP/USD assumed further journey southwards on Monday. The price dropped by more than 90 pips, having dropped by 250 pips since the beginning of last week. Since the outlook on GBP pairs remains bearish for this week, it is anticipated that price would continue going downwards, reaching another accumulation territories at 1.3250, 1.3200 and 1.3150.

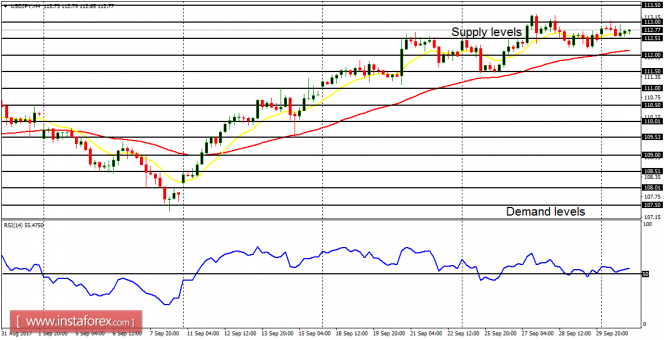

USD/JPY: There is a bullish bias on the USD/JPY. This week and this month, the movement in the market would be determined by whatever happens to USD. A stronger USD would mean the market would continue going north, while a weaker USD would result in a protracted bearishness that could eventually lead to a "sell" signal.

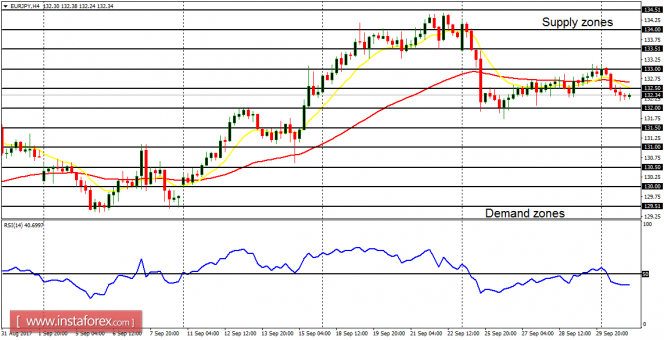

EUR/JPY: This cross traded lower on Monday, thus generating a "sell" signal in the market. It is likely that the demand zones at 132.00, 131.50 and 131.00 would be tested soon. One factor that may make this expectation possible is the weakness in EUR itself. It would be difficult for the cross to go seriously upwards when EUR is very weak.