All our targets which we predicted in yesterday's analysis have been hit. The pair is expected to continue its upside movement. Despite the recent pullback, the pair is trading above its rising 50-period moving average. The relative strength index is above its neutrality level at 50. Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

The U.S. Commerce Department reported that the country's trade deficit declined to US$42.4 billion in August, the lowest level since September 2016. Orders for non-defense capital goods (excluding aircraft) rose 1.1% on month in August, higher than +0.9% previously estimated. The Labor Department said initial jobless claims fell by 12,000 to a seasonally adjusted 260,000 in the week ended September 30, lower than 270,000 expected.

The Labor Department will release the closely-watched September jobs report tonight. It is expected that the U.S. economy added 80,000 new jobs (vs. +156,000 in August), average hourly earnings were up 0.3% on month, and the jobless rate was stable at 4.4%.

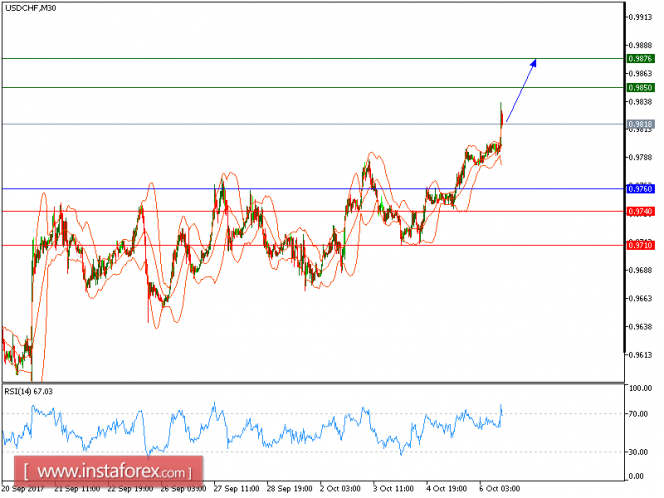

Hence, as long as 0.9760 (the high of Oct. 4) is support, look for a new challenge to 0.9850 and even to 0.9875 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 0.9760, Take Profit: 0.97850

Resistance levels: 0.9850, 0.9875, and 0.9915

Support levels: 0.9740, 0.9710, and 0.9685

The material has been provided by InstaForex Company - www.instaforex.com