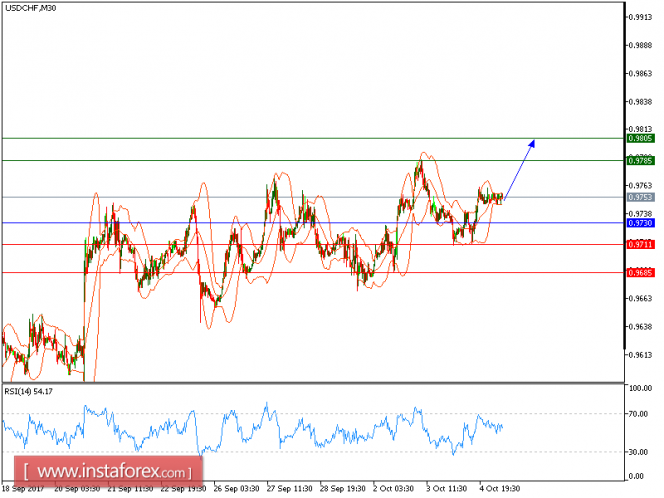

USD/CHF is expected to trade with a bullish outlook. The pair made a rebound and broke above its 20-period and 50-period averages. In addition, the 50-period moving average is turning up. The relative strength index is bullish, calling for a further upside.

The U.S. dollar lacked momentum in either direction as investors are alert to U.S. President Donald Trump's nomination for the Federal Reserve chair in the coming weeks. They were also cautious ahead of the official September jobs report due Friday. The ICE Dollar Index edged down to 93.45 from 93.56 Tuesday.

To conclude, as long as above 0.9730 holds on the downside, look for a new advance with targets at 0.9785 and 0.9805 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 0.9745, Take Profit: 0.9700

Resistance levels: 0.9785, 0.9805, and 0.9845

Support levels: 0.9710, 0.9685, and 0.9625

The material has been provided by InstaForex Company - www.instaforex.com