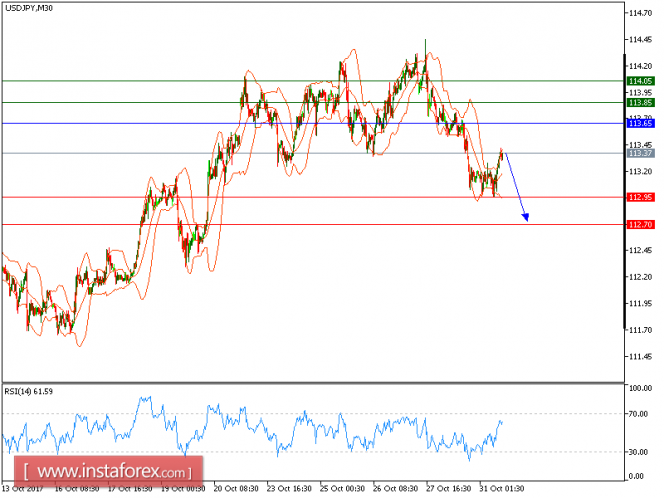

USD/JPY is under pressure. The pair recorded lower tops and lower bottoms since October 27, which confirmed a negative outlook. The downward momentum is further reinforced by both declining 20-period and 50-period moving averages. The relative strength index is bearish and calls for a further drop.

To conclude, as long as 113.65 holds on the upside, look for a new test to 112.95 and even to 112.70 in extension.

Alternatively, if the price moves in the opposite direction, a long position is recommended above 113.65 with a target at 113.85.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 113.65, Take Profit: 112.95

Resistance levels: 113.85, 114.05 and 114.45 Support Levels: 112.95, 112.70, 112.40

The material has been provided by InstaForex Company - www.instaforex.com