Bulls and bears in the EUR/USD decided to declare a truce. Each of the opponents tries to gain time. Euro buyers expect a solution to the conflict over Catalonia, where all the dogs, it seems, have decided to depend on to President Carles Puigdemont. Withdrawal from the shadow of political risks will return the attention of investors to the issues of normalization of the monetary policy of the ECB, which will allow to count on the recovery of the uptrend in the main currency pair. Fans of the dollar are betting on the passage of tax reform through the Congress and the choice of Donald Trump for the post of the chairman of the Fed. The acceleration of the US economy and increasing the likelihood of tightening the monetary policy of the Federal Reserve over the past few years have faithfully served the bulls at the USD index.

If in 2015-2016 the US dollar had no competitors among the G10 currencies, since the Fed was the only central bank that was tightening monetary policy, in 2017 the situation changed. The recovery of the economies of the monetary bloc countries and the defeat of Eurosceptics in the Netherlands and in France allowed the ECB to openly talk about the exit from the QE. According to reliable sources from Bloomberg, the European regulator is considering the possibility of reducing purchases from the current 60 to 30 billion euros per month from January 2018. Benoit Coeure argues that if the program lasts too long, the risks of financial instability will grow by leaps and bounds.

Thus, if a year or two ago the successes or failures of the dollar were connected with internal factors, primarily with the uncertainty or determination of the Fed, then this year its competitors made it an outsider. A part of the losses can be reversed by the implementation of the tax reform and reorganization in the Fed. If yesterday's hawk Kevin Warsh comes to power, the risks of aggressive monetary restriction will accelerate the current correction on the USD index. Experts of the Wall Street Journal prefer this particular candidate (probability 28% versus 21-22% for the main competitors), while bookmakers bet on Jerome Powell.

Dynamics of the probability of winning candidates for the post of head of the Fed

Source: Zero Hedge.

In my view, it is not necessary to count especially on the fact that hawks will dominate the new FOMC structure. Donald Trump has repeatedly said that he is a fan of low interest rates and a weak dollar, besides GDP can accelerate to 3% much earlier, if the Federal Reserve postpone the normalization of the monetary policy. Thus, the potential for a possible correction in EUR/USD looks limited to 1.14-1.16.

In order to be able to talk about the recovery of the "bullish" trend in the main currency pair, political risks must disappear the eurozone, and adoption of a bill to amend the tax code should be delayed. For now, it's too early to discuss this, therefore, the most preferred option for the EUR/USD development is consolidation.

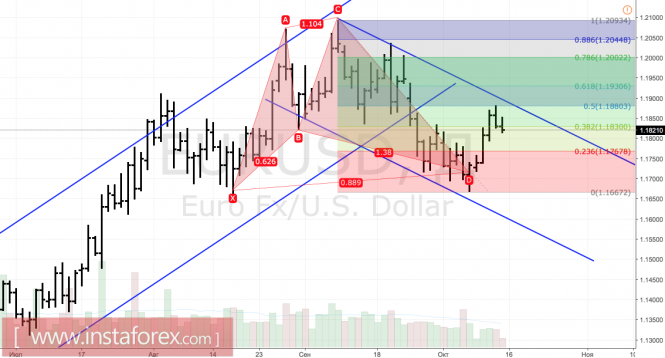

Technically, rebound from resistance by 50% and 61.8% from the wave of CD pattern 5-0 can be used for euro selling.

EUR/USD, daily chart