Trading plan for 05/10/2017:

An unexpected drop in retail sales in Australia was the only volatile moment of sleepy trading hours in Asia. The rest of forex pairs remained in narrowband fluctuations. The DXY Dollar Index is unmoved, the EUR/USD pair has found a stop at 1.1750, and USD/JPY cannot break through at 112.90. It was also quiet on the stock market. Crude Oil remains close to $50, and Gold holds at $1,275 level.

On Thursday 5th of October, the economic calendar is light in important news releases. Early in the morning, Switzerland will release Consumer Price Index data and ECB will release Monetary Policy Meeting Accounts data. During the US session, Canada will release Trade Balance data and the US will post Unemployment Claims and Factory Orders data. Some speeches are scheduled later today from FOMC members Jerome Powell, Patrick Harker, and John Williams.

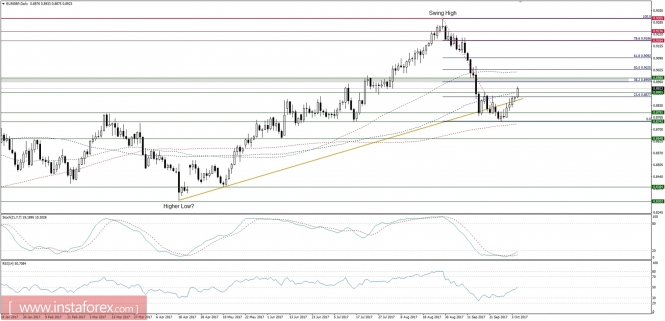

EUR/USD analysis for 05/10/2017:

Financial market participants will be most interested in European Central Bank Policy Meeting Minutes that are scheduled for release at 11:30 am GMT. Usually, these post-meeting minutes have a rather low impact on markets, but today it might be different, given the heightened role of the currency and overall financial conditions in the ECB's policy reaction function. Moreover, the minute's report may hint the ECB Governing Council's QE taper preferences as well. Recently the official ECB point of view was wariness over additional EUR strength, but in the minutes there might be some discussions leaning towards acceptance of a strong EUR under certain economic conditions. This small shift in tone would be a giant leap forward for all EUR bulls. There is a low probability, that there'll be too much in the way of exact details on how the ECB might taper its asset purchases, but the current anticipation of a pace of the asset purchases is rather cautious, so any mentions that taper may be bigger (in size) and faster (in time) will definitely support the EUR across the board.

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The key level to the upside is the technical resistance at the level of 1.1847, so as long as the market stays below this level the bias is bearish. The upside momentum is decreasing as the RSI indicator can barely move above its fifty level so far. The key technical support is at the level of 1.1614.

Market Snapshot: EUR/GBP bouncing higher

The price of EUR/GBP has broken above the technical resistance at the level of 0.8901 and now is heading towards the 38%Fibo at the level of 0.8959. The market conditions are oversold on a daily time frame, but the momentum oscillator is still under its fifty level (but pointing north). The next technical resistance is seen at the level of 0.8980.

Market Snapshot: GBP/USD breaks below the trend line

The price of GBP/USD has definitely broken below the trend line and now is trading close to the level of technical support at 1.31 54. Nevertheless, there is a clear, visible bullish divergence between the price and momentum oscillator, so some kind of a corrective counter-trend move is expected soon.