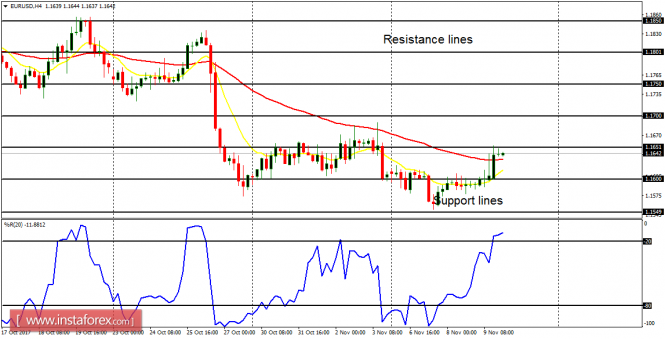

EUR/USD: The EUR/USD moved higher on Thursday, but that movement was not significant enough for a clean bullish bias. A movement above the resistance line at 1.1700 would result in a bullish bias, while a movement below the support line at 1.1550 would help strengthen the recent bearishness in the market.

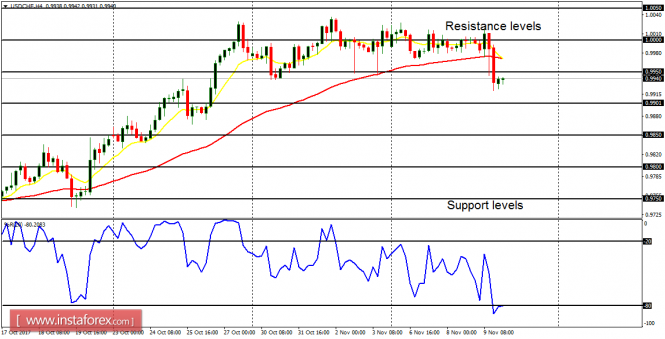

USD/CHF: This pair moved lower on Thursday, but that movement was not significant enough for a clean bearish bias. A movement below the support level at 0.9900 would result in a bearish bias, while a movement above the resistance level at 1.0050 would help strengthen the recent bullishness in the market.

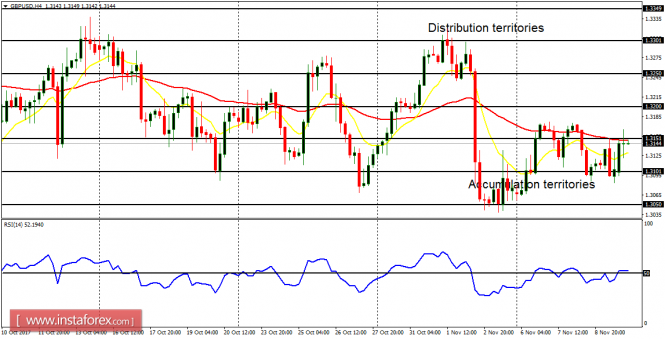

GBP/USD: In spite of the volatility in the market, there is some bearish bias on the Cable. Things are looking dicey right now, but a directional movement is imminent. The market is expected to go downwards, reaching the accumulation territories at 1.3100, 1.3050 and 1.3000 (which would be attained today or next week).

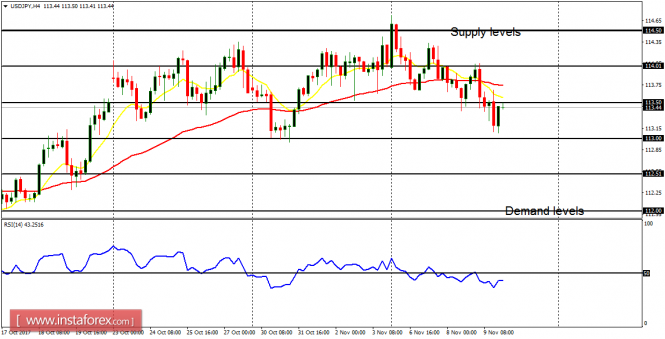

USD/JPY: A short-term "sell" signal has been generated on the USD/JPY. Price has gone below the supply level at 113.50; and now going towards the demand level at 113.00. It is expected that the pair would go further downwards than that.

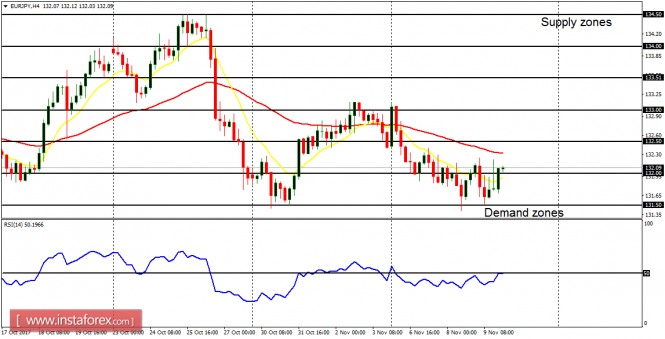

EUR/JPY: This cross is still bearish; with the EMA 11 below the EMA 56 and the RSI period 14 below the level 50. The next target for bears are located at the demand zones at 131.50, 131.00 and 130.50. Rallies along the way are ought to be contained at the supply zones at 132.50, 133.00 and 133.50.