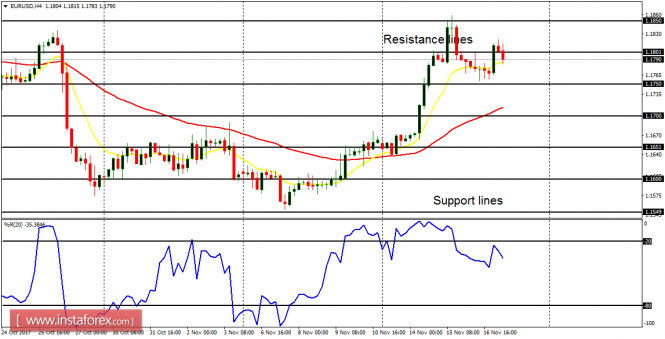

EUR/USD: The EUR/USD rallied significantly this week, to test the resistance line at 1.1850. After that, there has been a slight bearish correction as price moves sideways. However, it is expected that price would resume its bullish journey and test the resistance line at 1.1850 again, breach it to the upside, and aim for another resistance line at 1.1900.

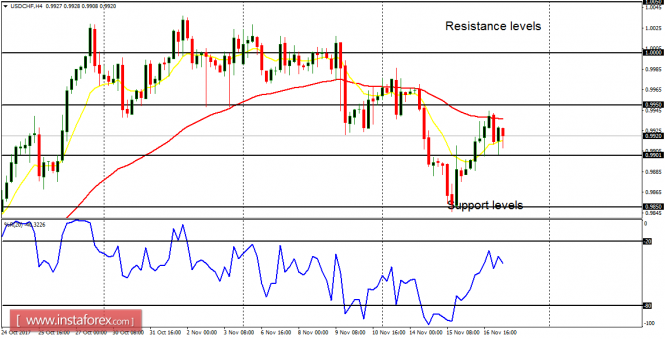

USD/CHF: This currency trading instrument dropped this week, to test the support level at 0.9850; after which price bounced upwards. The upwards bounce can be treated as a transient rally in the context of a downtrend. Price can come down again, to test the support levels at 0.9900 and 0.9850.

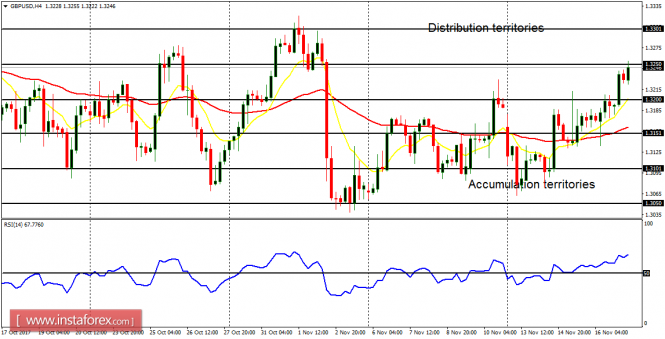

GBP/USD: There is now a vivid Bullish Confirmation Pattern on the GBP/USD. The price has moved very close to the distribution territory at 1.3250, which would be breached to the upside as the price goes further northwards. The bullish effort that was seen this week, has put an end to the consolidation phase in the market.

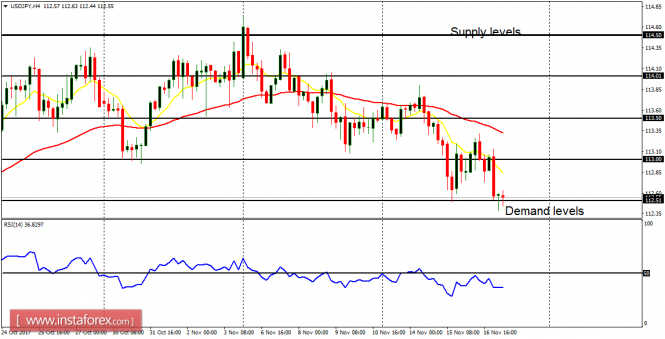

USD/JPY: There is also a bearish signal on this pair. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50. It is anticipated that price would continue going downwards, reaching the demand levels at 112.50, 112.00, and 111.50. The targets would be reached before the middle of next week.

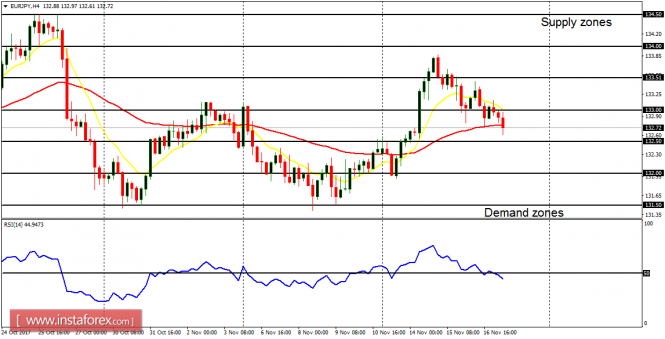

EUR/JPY: The EUR/JPY went upwards on Monday and Tuesday, and then came down on Wednesday and Thursday. The downward movement has nearly posed a threat to the extant bullish bias. Unless price goes upwards from here (to save the bullish bias), the bullish bias would become invalid, especially when the demand zone at 132.00 is breached to the downside.