The FOMC minutes of meeting will be published today dated November 1, with high possibility that the markets will ignore the release because there were several important events happened after the meeting that changed the risk assessment. Therefore, the internal discussion of the last meeting could be regarded by the market as irrelevant. Looking back, the meeting took place before the issue was solved upon appointing the new Fed Chair and before the presentation of tax reform plan to the Congress. Hence, the accents are placed differently than three weeks ago.

Despite lack of important macroeconomic news, the stock index S&P 500 was able to cross the mark of 2,600 points yesterday for the first time in history. The positive attitude of investors in the demand shares reflects the market's opinion on the US economic outlook, which looks quite stable at the moment.

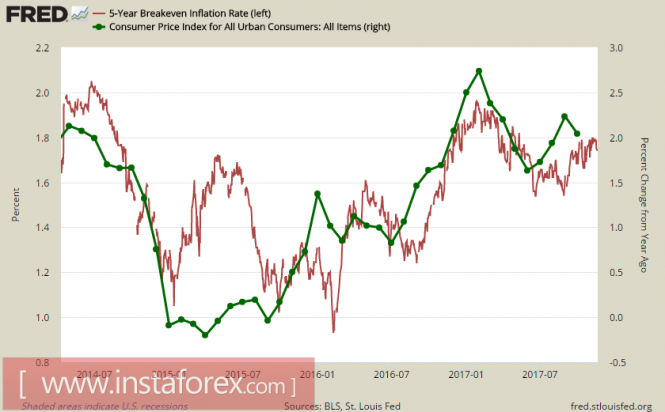

Fed Chairman Janet Yellen, speaking at the NYU Stern Business School in New York, said the Fed is close enough on its mentioned targets and should continue the policy of gradually raising interest rates. According to Yellen, low inflation is a temporary factor, but neither she nor her colleagues are convinced that the weakness of inflation is caused by temporary factors.

The business partly shares fears on real inflation expectations, measured as the profitability of inflation-protected 5-year TIPS bonds, continue to be well below the January peak levels. This indicates uncertainty about the future recovery in price growth.

According to other criteria, the tension regarding the prospects for the US economy is dropping noticeably. The Atlanta Fed predicts GDP growth in the fourth quarter at 3.4%. As expectations on the rate remain positive, the market is convinced that the rate will be raised in December by a quarter percent, and the next increase with a probability of more than 55% will take place in March 2018. Such positive expectations have a calming influence on investor sentiment and stimulate the purchase of US assets, which is observed in the dynamics of stock indices.

The external background also remains favorable for bulls. The failure of negotiations on the creation of a coalition government in Germany increases the risks for the euro area and worsens the position of the euro. While the dollar especially the pound may benefit, as the EU positions in the negotiations on Brexit will be weakened.

As for the negotiations on the NAFTA agreement, there finally appeared reasons for cautious optimism for the first time in six months. The fifth round of negotiations in Mexico City is marked by "reached understanding" for some heads of the agreement that ended the previous day. The next round will be held in Montreal, Canada in the second half of January, but by mid-December the parties intend to report on the successful achievements in the negotiations. It should be noted that for Trump the achievement of consensus with the two partners is an important stage in the process of promoting tax reform in the Congress, as it facilitates the return of jobs to the United States.

Today, the data for durable good orders will be published in October, there are some doubts that they will confirm production growth. Also, the University of Michigan report on November consumer confidence will be today, it is projected to grow to 98p against 97.8p in October. This indicates growth in positive expectations among US population from changes in tax legislation.

On Thursday, the markets in the US will be closed in connection with the Thanksgiving Day, so the players will remain active until the end of the week. After the publication of the FOMC minutes today, the outbreak of volatility is expected upon partially closing of the positions. Despite some loss of momentum, the dollar remains the favorite currency until the end of the week. Moreover, trade will continue most likely within the established ranges due to lack of a strong market driver.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com