For most of the past month, gold has been trading in a narrow range of $1270-1290 per ounce after falling 5% from its September highs on fears of aggressive monetary tightening by the Fed. As its reason is the distribution of the US economy under the influence of tax reform. Despite its lack of success during autumn, prices for precious metals have risen by almost 12% since the beginning of the year, which is much better than the results of most commodity market assets. The composite index of which has not even moved farther away from the starting points of the current year.

Dynamics of the commodity index from Bloomberg

Source: Bloomberg.

The transition to a consolidation is justified from a fundamental point of view. Acceleration of inflation in the US under the influence of fiscal stimulus will force the Fed to aggressively raise the federal funds rate. This will strengthen the dollar and increase the yield of treasury bonds, which is a "bearish" factor for the XAU/USD. Fears for the implementation of this scenario causes gold to move towards a different direction. The same thing happened during the collapse in 2013. As a result of October, Switzerland exported the largest volume of gold in the last 4 months: to India - 38.1 tons, to China - 34.5 tons, to Hong Kong - 19.7 tons.

On the other hand, if the Congress does not pass the tax reform or is implemented in a curtailed form, then a wave of selling will flow into the US stock market. A correction of the S&P 500 will signal a worsening global appetite for risk, which, in general, positively affects gold. Uncertainty about the outcome of voting in the Senate forces investors to refrain from premature opening of positions and promotes consolidation.

Another reason for caution is the ambiguous reaction of the market towards events in Germany. On the one hand, the political crisis in eurozone's largest economy threatens to pull down business activity and slow the GDP, which increases the demand for safe haven assets; on the other, it leads to a decrease in quotes of the EUR/USD pair, which adversely affects gold.

Along with the Fed's monetary policy and political risks in the United States and in the Eurozone, the support for precious metal is also being maintained by geopolitical tensions surrounding North Korea. Donald Trump said that the US will consider this country as a state sponsor of terrorism, which clearly provoked Pyongyang's discontent. In recurrence of the story with the launch of ballistic missiles, this could lead to the emergence of futures from the trading range of $1,270-1290 per ounce.

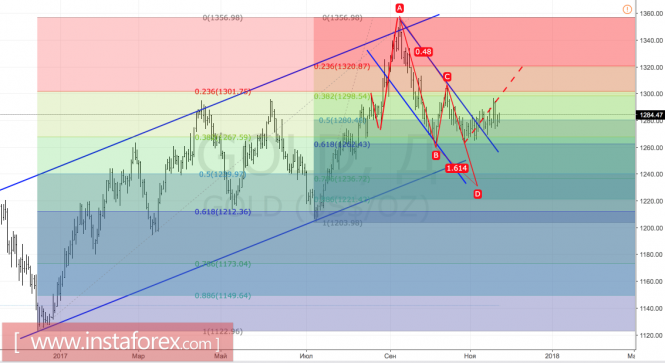

A technically necessary condition for gold's recovery of the upward trend is a successful attack on the resistance at $1299-1302. On the contrary, the drop in quotations below the support at $1262 will increase the risks of implementing the targets by 127.2% and 161.8% on the AB=CD pattern.

Gold, daily chart