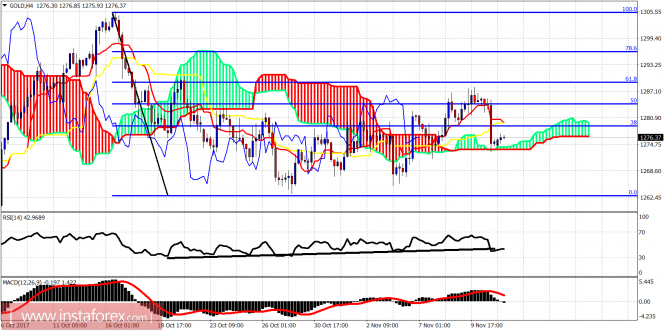

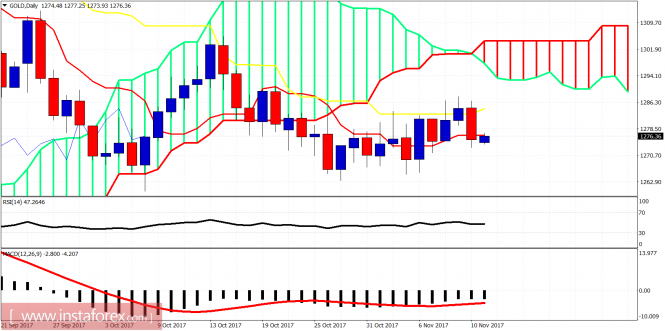

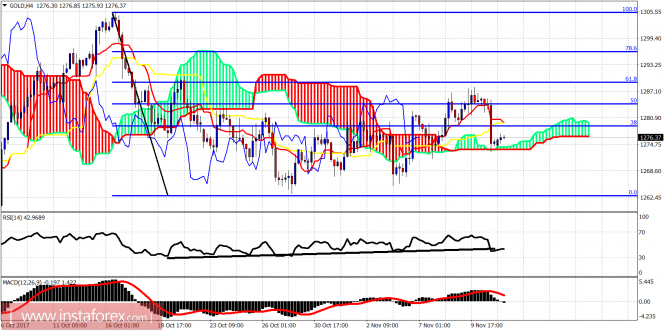

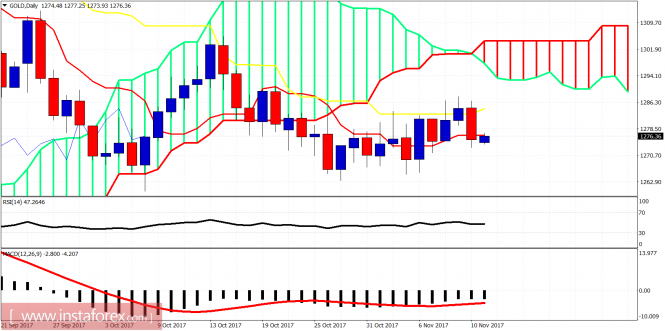

Gold price made a sharp reversal on Friday getting rejected once again at the $1,283-88 resistance area and where we also warned that the important 61.8% Fibonacci retracement was. Price has now tested the Ichimoku cloud support and is bouncing.

In the mean time you can connect with us with via:

Welcome To Money Grows Network

2006 - 2019 © www.moneygrows.net

Investments in financial products are subject to market risk. Some financial products, such as currency exchange, are highly speculative and any investment should only be done with risk capital. Prices rise and fall and past performance is no assurance of future performance. This website is an information site only.

Gold price made a sharp reversal on Friday getting rejected once again at the $1,283-88 resistance area and where we also warned that the important 61.8% Fibonacci retracement was. Price has now tested the Ichimoku cloud support and is bouncing.