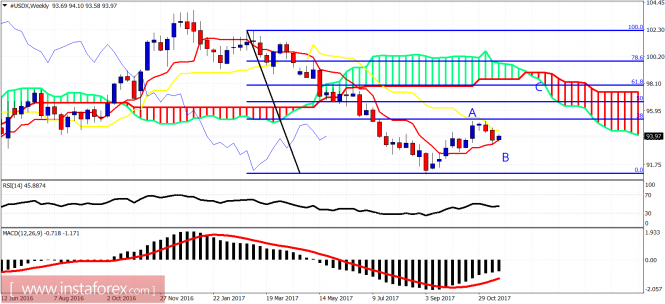

The Dollar index is making new short-term higher highs but price remains below the cloud. Trend remains bearish in the medium-term. There are still chances that the entire decline from 95 is not over and we could see a move towards 93-92.50.

Green rectangle - support

Red rectangle - target if support fails

The Dollar index stopped the decline at the 38% Fibonacci retracement. Price is below the 4-hour Kumo, so we consider short-term trend still bearish. Resistance is at 94.30-94.50. Breaking above it will open the way for a move towards 97 or higher. Support at 93.60-93.50 is also important. A break below it will open the way for a move towards the red rectangle area.