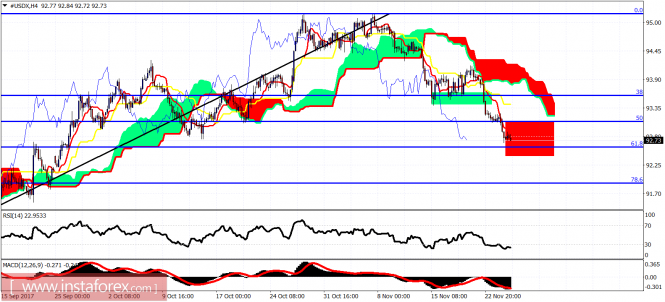

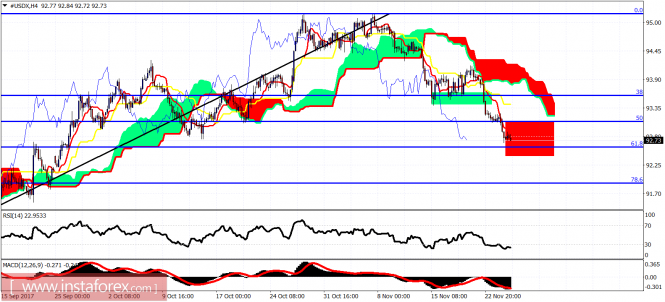

The Dollar index has reached our short-term target area and the 61.8% Fibonacci retracement at 92.50. I expect a reversal from current levels to the upside. However we have still not seen any reversal sign.

Green rectangle - support area (broken)

Red rectangle - target area (reached)

The Dollar index has finally reached our short-term target. Trend is bearish as price remains below the 4 hour Kumo (cloud). Support is at the 61.8% Fibonacci retracement at 92.50 while resistance is at 93.40 and next at 93.90.

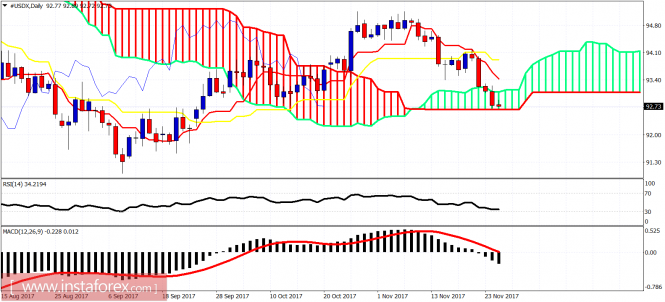

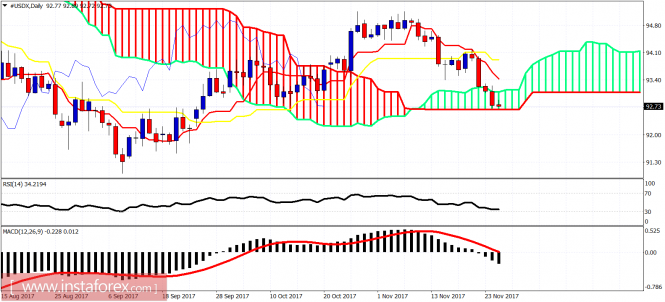

The Dollar index has entered the Ichimoku cloud area in the daily chart. A daily close below the cloud will be a bearish sign. Trend is neutral but very close to turning bearish again on a daily basis. I expect the Dollar index to bounce from the cloud support. Important Daily resistance at 94.10. Break above it and we could see more than just a bounce in the Dollar.The material has been provided by InstaForex Company -

www.instaforex.com