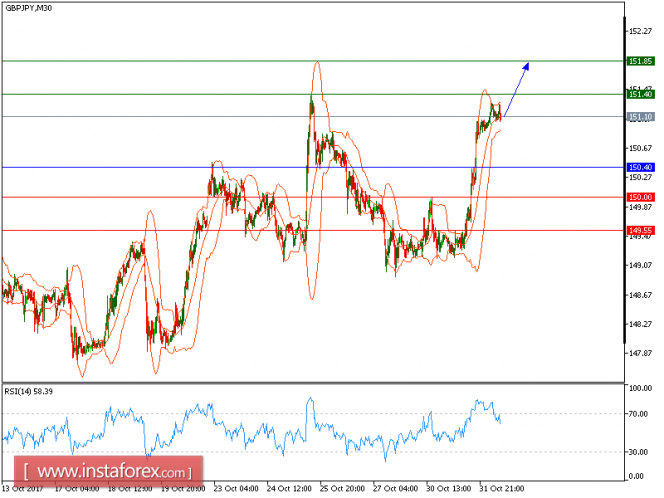

All our targets which we predicted in Yesterday's analysis has been hit. GBP/JPY is still expected to trade in higher range. The pair remains on the upside as long as it stays above 150.40. Currently, it is trading around the ascending 20-period moving average, which stands above the 50-period one. The relative strength index sits at levels above 60, indicating continued upward momentum for the pair. Overhead resistance is at 151.40. Above that, expect a further advance toward 151.85.

Alternatively, if the price moves in the direction opposite to the forecast, a short position is recommended below 150.40 with the target at 150.00.

Strategy: BUY, Stop Loss: 150.40, Take Profit: 151.40

Chart Explanation: the black line shows the pivot point. The price above the pivot point indicates long positions; and when it is below the pivot points, it indicates short positions. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 151.40, 151.85 and 152.45

Support levels: 150.00, 149.55, and 149.00

The material has been provided by InstaForex Company - www.instaforex.com