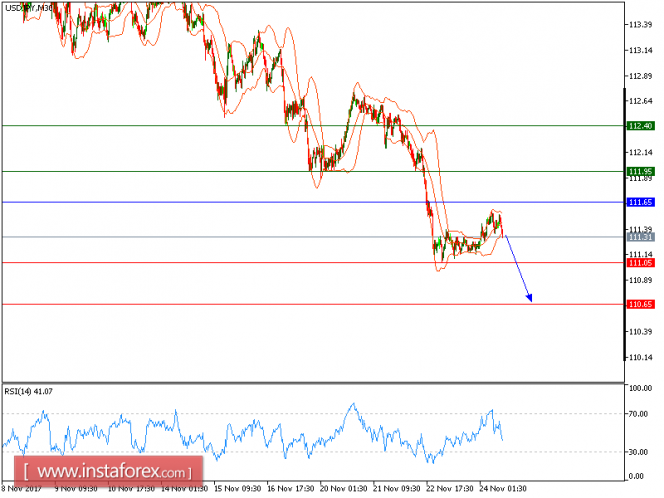

USD/JPY is under pressure. The pair is under pressure below the key resistance at 111.65, which should limit the upside potential. The U.S. dollar remained subdued as the euro maintained its strength in face of upbeat euro zone business data and growth in the German economy.

As long as this key level is holding on the upside, look for a drop to 111.05. A break below this level would trigger another decline to 110.65.

Alternatively, if the price moves in the opposite direction, a long position is recommended above 111.65 with a target at 111.95.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 111.65, Take Profit: 111.05

Resistance levels: 111.95, 112.40 and 112.70 Support Levels: 111.05, 110.65, 110.30

The material has been provided by InstaForex Company - www.instaforex.com