Eurozone

In the absence of significant macroeconomic news, the euro continues to be under pressure. Investors are reacting to the indistinct results of the ECB meeting a week ago with the selling of the euro, as the prospects for a return to normal macroeconomic policies remain unclear, and especially the negative is beginning to materialize against the background of hawkish news from the United States.

On Monday business activity indices from Markit for the eurozone nations will be published, as well as an indicator of consumer confidence from Sentix. The forecasts are neutral, therefore the data release is unlikely to have a noticeable impact on the markets. On Tuesday, data for September on industrial production in Germany and retail sales in the eurozone in September will be released.

The eurozone economy is in a stable state, and there are no reasons for investors to worry. At the same time, the ECB, abandoning the initiative in matters of monetary policy, provokes the outpour of speculative capital from the eurozone and realizes the goal to stop the growth of the European currency. The market does not object and sees no reason to return to the upward movement. The euro will continue to trade in the range with a downtrend, next week may reduce EURUSD to 1.1550.

United Kingdom

The Bank of England, as expected, raised the interest rate by a quarter point for the first time since 2008. Concerning further plans, the bank preferred not to disclose the information, confining itself to a remark in the style of "we will closely monitor the incoming data."

Mark Carney said at the press conference that only a small adjustment was made, and noted that the horizon of expectations for inflation is increased due to uncertain prospects for Brexit.

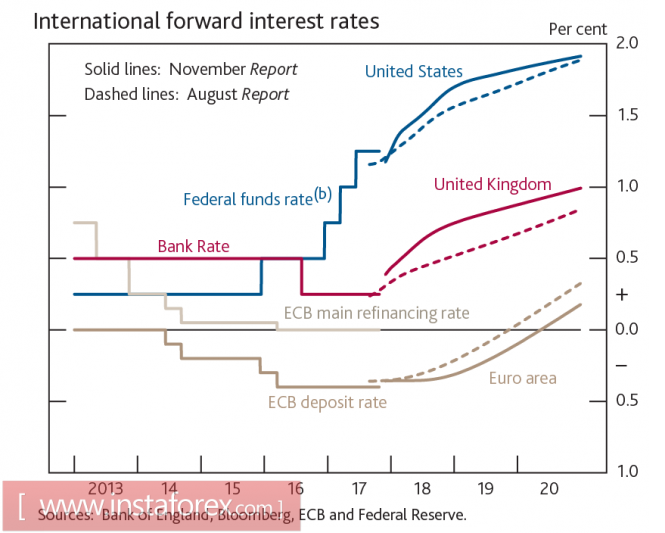

Expectations on rates indicate an improvement in the pound's position if we take into account the dynamics of the spread between the Fed, the EBC and the Bank of England. Compared to August, the growth of rates in the UK is expected to be more dynamic, for the Fed, the forecast increase is slightly less, but for the euro, the forecast is revised downwards, that is, the Bank of England assumes that market expectations for aggressive actions of the ECB may not be justified.

Such dynamics, if implemented, will lead to a faster demand for the pound, as it will increase the attractiveness of British assets, primarily against the European ones. This forecast looks at the true goal of Brexit, which is to create a more attractive investment climate for European capital, which will help the United Kingdom jump on the footsteps of the train leading to the "Brave New World" and create conditions for maintaining the pound's position as one of the world's reserve currencies.

However, this scenario still needs to be realized. Against the US dollar, the pound is under pressure amid profit taking after the Bank of England meeting and the overall positive for the dollar, the nearest target is 1.2850, but has a chance to resume growth against the euro, the nearest target is 0.8680.

The more distant and strong support is 0.8300, which the EURGBP can decline to already by the end of November.

Oil

Brent, for the first time in 28 months overcame the mark of 62 dollars per barrel, and it seems that this is still far from the limit. The growth in prices was not prevented by reports on the increase in production volumes in the US, as the market is gradually developing expectations of reaching a deficit that will result from the actions of the OPEC + agreement and the growing demand, primarily from the Asian countries.

Oil can continue to grow, as the effects of fundamental factors are not weakening yet. Technically, the daily overbought schedule has not yet been observed, a corrective decline to $60/bpd will be used with high probability for new buying.

The material has been provided by InstaForex Company - www.instaforex.com