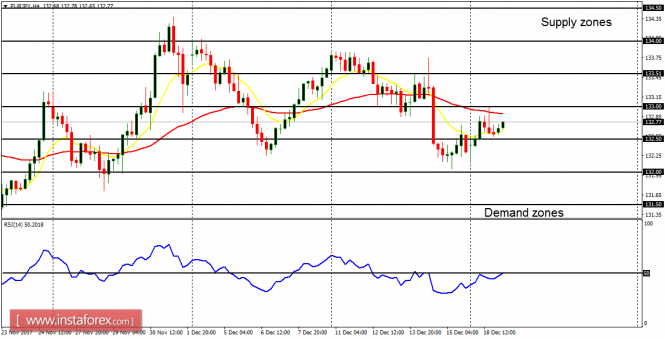

EUR/USD: This pair has not assumed any directional movement this week, as it is consolidating in the short term. A rise in momentum is expected and it would most probably favor bears. A further bearish movement is expected this week as price is going towards another support line at 1.1700.

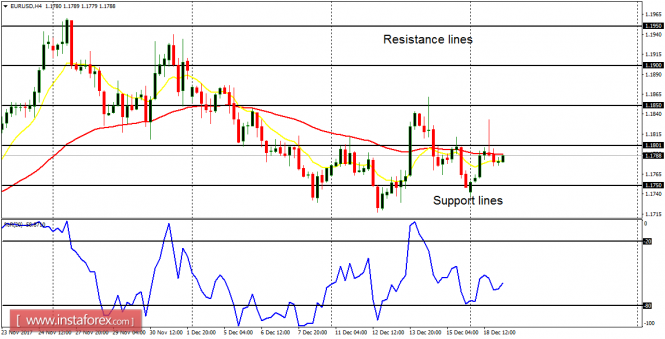

USD/CHF: The USD/CHF pair

has generated a short-term "sell" signal. Price can go towards the support levels at 0.9850 and 0.9800. On the other hand, there are resistance levels at 0.9900 and 0.9950, which should serve as an impediment to any bullish attempts. There is also another great resistance level at 1.0000.

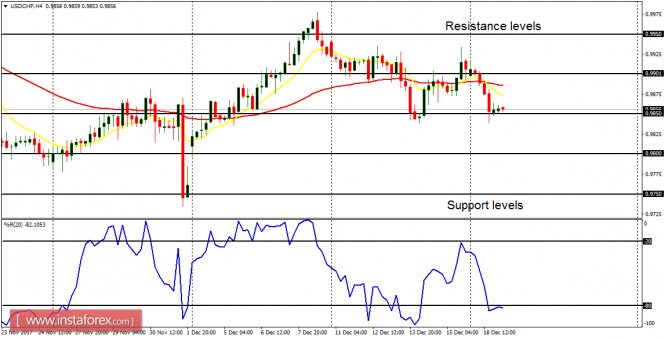

GBP/USD: This market is consolidating at best, and there is no directional, perpetual movement at the present. Last week, the market reached the distribution territory at 1.3450 and the accumulation territory at 1.3300. Either of these boundaries would be breached this week, as price assumes a directional movement.

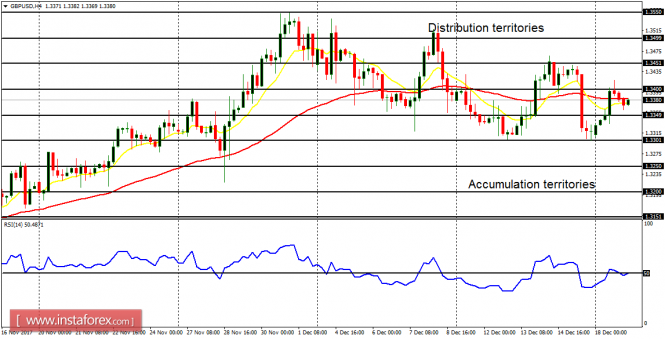

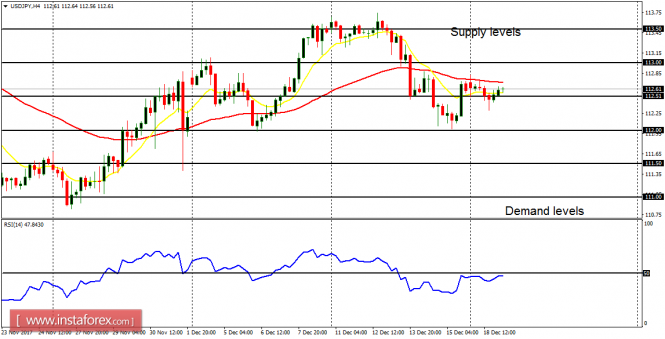

USD/JPY: There is a Bearish Confirmation Pattern in the short-term (on the USD/JPY pair). The market has remained calm since the beginning of this week, and that is calm before the storm (heavy volatility). The market would come down again to test that demands level, and possibly breach it to the downside.

EUR/JPY: This currency cross is quite choppy and without any direction on the higher time horizon. This kind of directionless scenario has been going on for more than two months and it seems to just be the beginning, unless there is a 300-pip movement to the upside or to the downside, which would result in a directional bias.