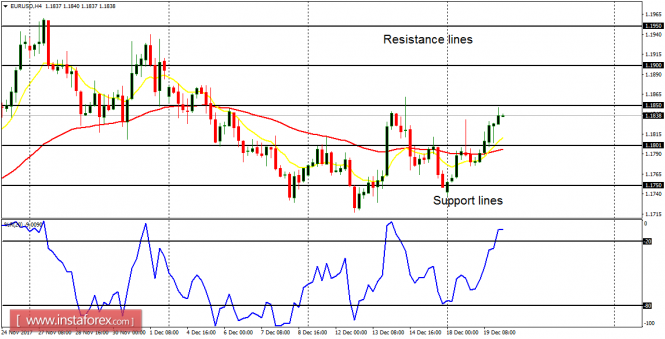

EUR/USD: There is a "buy" signal on the EUR/USD: The EMA 11 has gone above the EMA 56, and the Williams' % Range period 20 is now in the overbought region, indicating a strong bullish momentum in the market. This is just the beginning as the price is supposed to go above the resistance lines at 1.1900 and 1.1950.

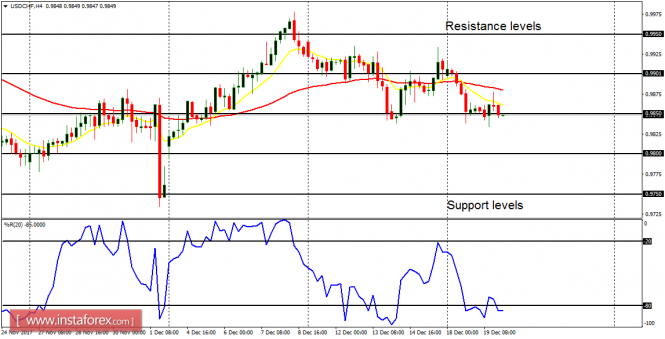

USD/CHF: The USD/CHF has generated a short-term "sell" signal. Price can go towards the support levels at 0.9850 and 0.9800. There is a great resistance level at 1.0000, and bullish machinations may not push price above that resistance level. The price should go southwards from here when a breakout happens.

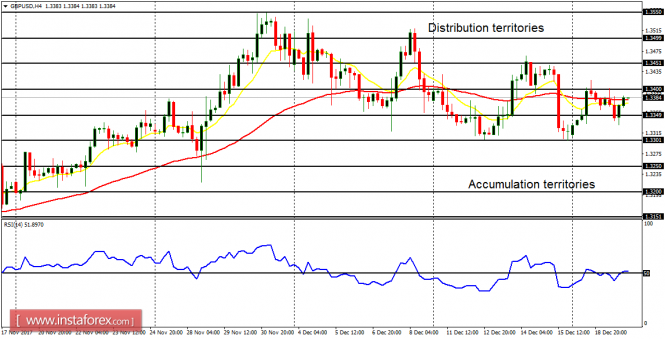

GBP/USD: This market is consolidating at best, and there is no directional, perpetual movement at the present. There are visible boundaries at the distribution territory at 1.3450 and the accumulation territory at 1.3300. Either of these boundaries would be breached this week, as price assumes a directional movement.

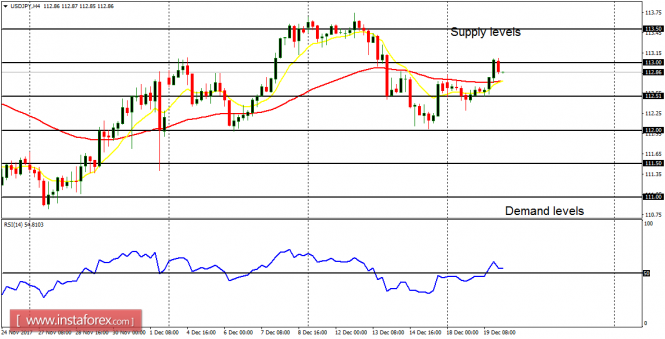

USD/JPY: Just like its EUR/JPY counterpart, the USD/JPY has also generated a bullish signal, which, though, is not as strong as that of EUR/JPY. There is a now a Bullish Confirmation Pattern in the 4-hour chart, and the price is expected to go further northwards from here, reaching the supply levels at 113.50, 114.00.

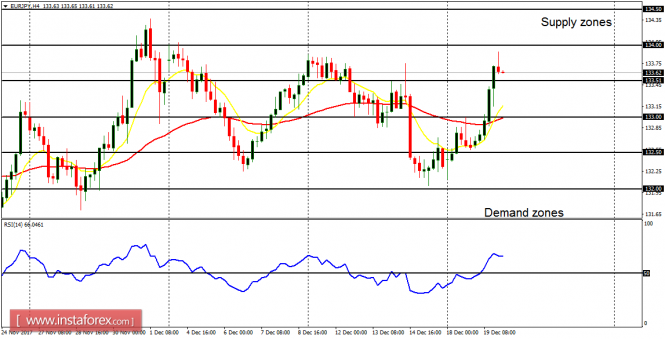

EUR/JPY: There is a bullish signal on the EUR/JPY, for price has gone upwards by 160 pips this week. Further upwards movement is anticipated, as price journeys towards the supply zones at 134.50, 135.00 and 135.50. It is even possible for these initial targets to be exceeded within the next several trading days.