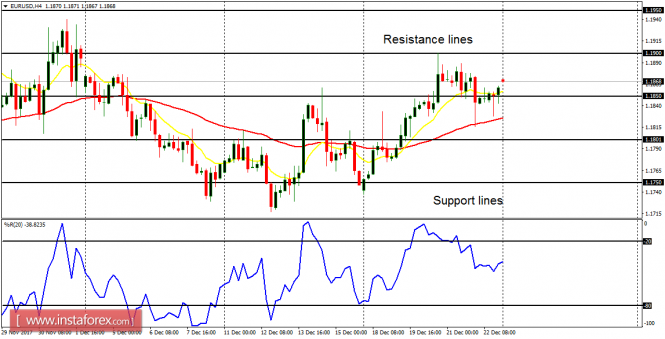

EUR/USD: The market has opened with a small gap-up, and that could mean a continuation of the bullish movement, whether the small gap-up is filled or not. Price could gain about 100 pips before the end of the week, and the movement is not expected to be huge. Next month – January – would be marked with strong volatility.

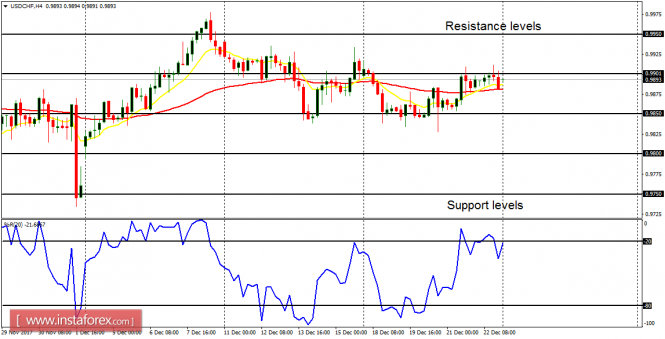

USD/CHF: The USD/CHF pair is yet to make any meaningful movement this week. The market is not expected to make any significant movement this week (because volatility would thin out). Price is thus expected to oscillate between the resistance levels at 0.9950 and support level at 0.9800 within the next several trading days. However, a breakout will occur early January.

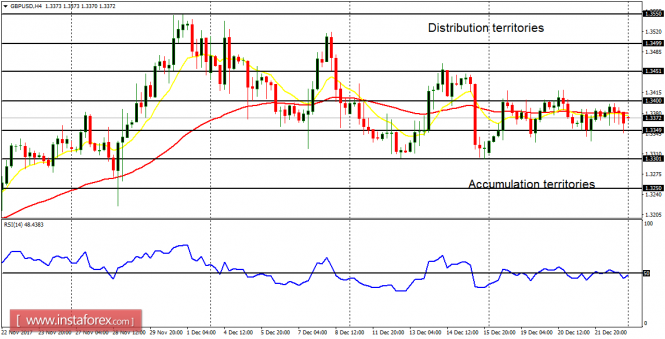

GBP/USD: The GBP/USD pair did not make any significant movement last week, neither is it expected to make any significant movement this week (because volatility would thin out). Price is thus expected to oscillate between the accumulation territory at 1.3250 and the distribution territory at 1.3500 within the next several trading days. However, a breakout will occur early January.

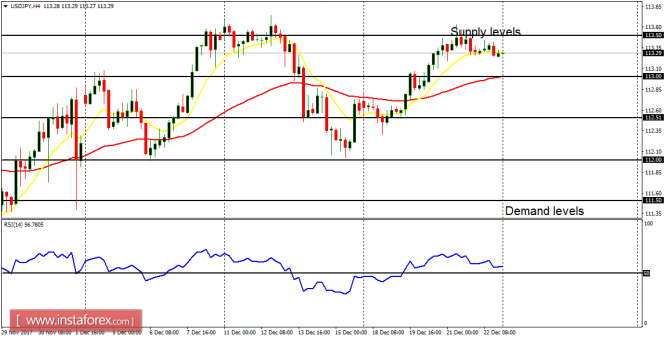

USD/JPY: This trading instrument also is yet to make any significant movements this week. The pair gained 150 pips last week, testing the supply zone at 113.50, and then closing below it on Friday. The bullishness in the market could be sustained until the end of this year (although it is unlikely that a strong movement would be witnessed).

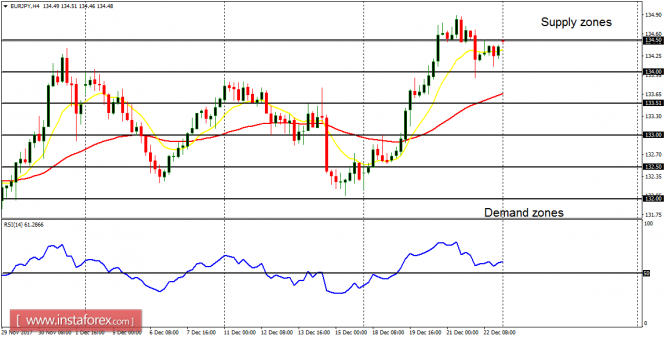

EUR/JPY: There is a Bullish Confirmation Pattern in the EUR/JPY market; plus it has opened with a small gap-up this week (which respects the existing bias). Price is expected to go northwards this week, gaining a maximum of 200 pips before the week runs out. So, the supply zones at 135.00, 136.00 and 136.50 could be reached.