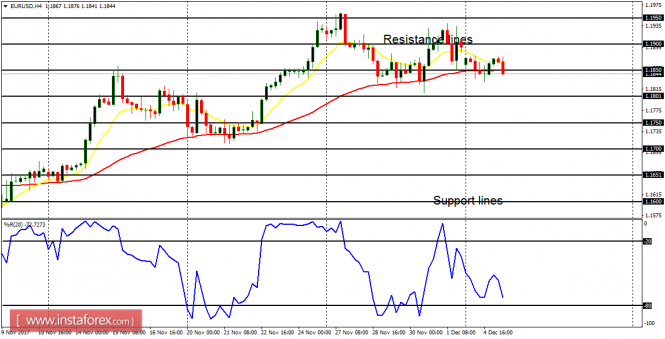

EUR/USD: The EUR/USD pair did not do anything significant yesterday; but the bullish bias is still present. A further bullish movement is possible this week, for price could target the resistance lines at 1.1900, 1.1950 and 1.2000. A stubborn opposition would be met at the resistance line of 1.2000.

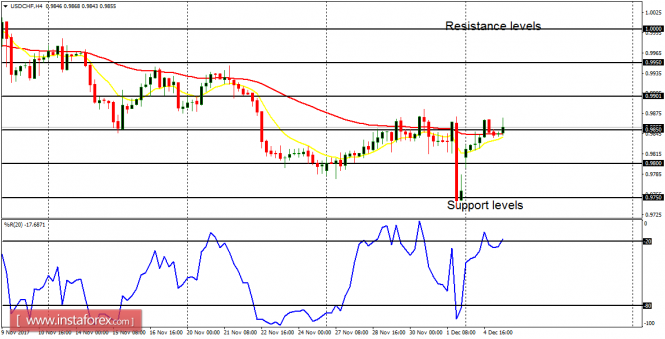

USD/CHF: The USD/CHF pair went downwards massively on Friday, and then opened this week with a gap-up. However, the bearish bias on the market remains valid. Unless the resistance level at 0.9900 is breached to the upside, there cannot be any threat the bearish bias. Further bearish movements are a possibility.

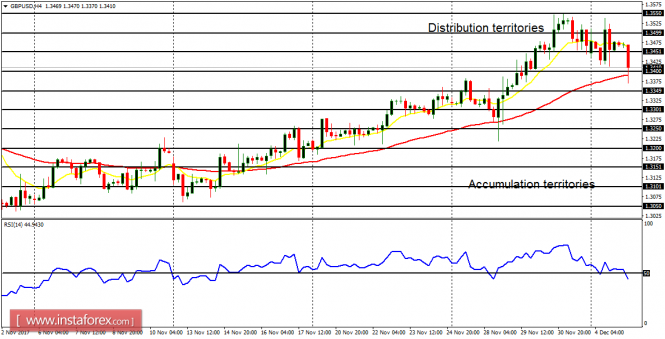

GBP/USD: The Cable has fluctuated southwards since the beginning of this week, and that is about to create a threat to the recent bullish effort in the market. A movement below the accumulation territory at 1.3300 would render the bullish effort invalid, while a movement to the upside (from here), would strengthen it.

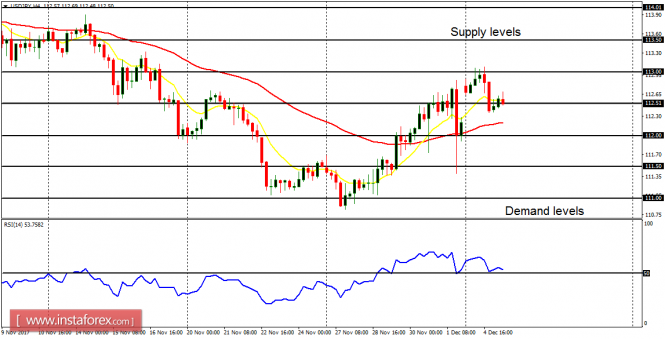

USD/JPY: This currency trading instrument opened with a minor gap-up this week. After the supply level at 113.00 has been tested, price began to consolidate. Since the bearish outlook on the market is still valid, the pair is expected to continue going downwards, towards the demand levels at 112.50, 112.00, and 111.50.

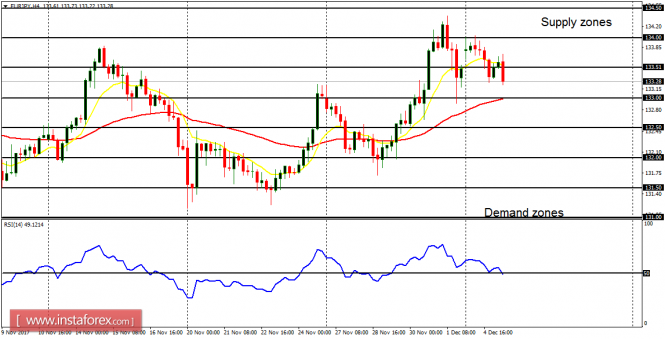

EUR/JPY: After this cross opened early this week, there has been a slight bearish correction in a context of an uptrend. The Bullish Confirmation Pattern in the 4-hour chart remains extant – unless price goes below the demand zone at 132.50. A movement upwards from here is anticipated, which would take price towards the supply zones at 133.50 and 134.00.